A rapidly evolving technology landscape and the recent pandemic have radically altered financial functions across organizations. No longer about spreadsheet-driven accounting or controlling costs, firms have been adopting a value-oriented approach to finance—and they have been increasingly turning to their CFOs for it.

From traditional financial work to specialty finance, strategic leadership to organizational transformation—the CFO is doing it all. Plus, another integral function—prepping and helping their companies go public.

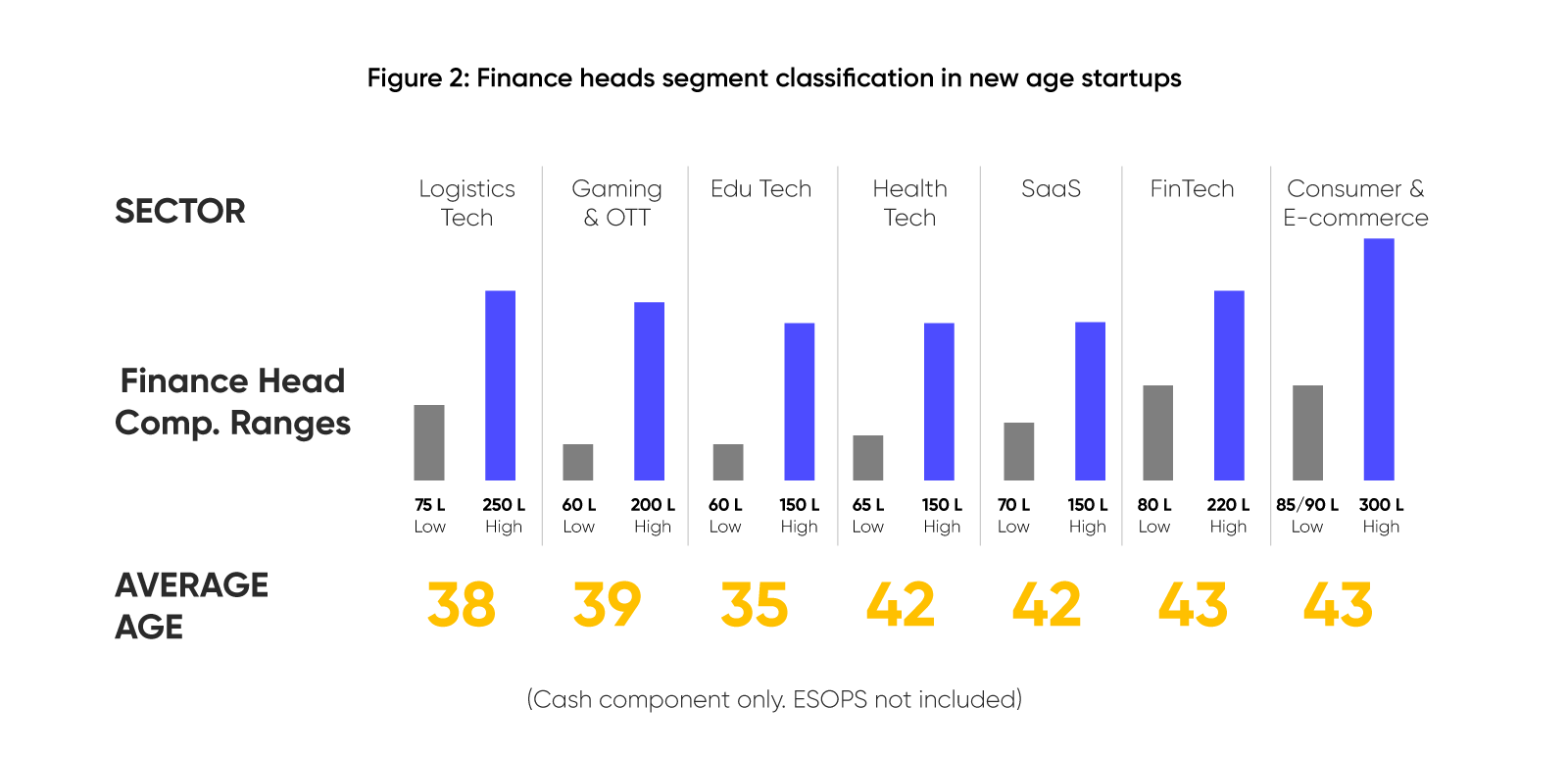

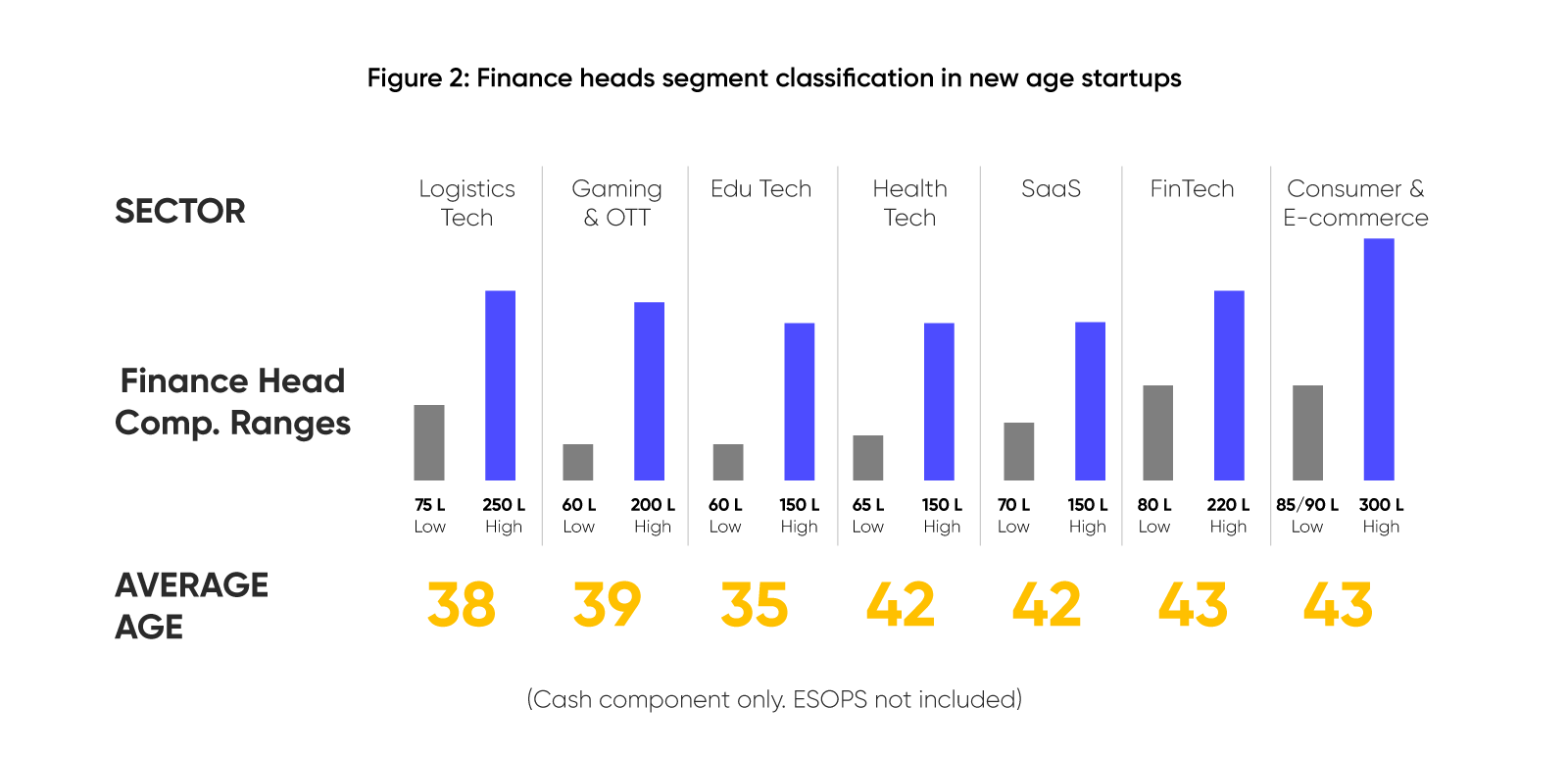

As businesses mature and get ready to raise their next level of public funding, the demand for CFOs who have experience in taking companies public has skyrocketed. Native analyzed talent trends (specifically for CFOs) in more than 165 companies that went public in the last 6 years and about 65 promising startups that may go public soon (see Figures 1 and 2).

The trend is only expected to climb in the coming years, forecasting several shifts across the talent community as making a company IPO-ready, is a specialization in itself. From building a compelling financial story that resonates with investor confidence to getting the house—and more specifically, the balance sheet—in order and presenting a strong and comprehensive financial foundation to meeting regulatory norms.

To pull this off, Figure 3 shows how companies trigger changes at the top level, specifically in the CFO office, as they start to prepare for an IPO.

Given the multiple regulatory reporting, and governance standards required, the CFO-in-charge will have to wear many, many hats. They need to have diverse experience, including (but not limited to) corporate finance, equity capital market, and investor relation competencies. Figures 4 and 5 highlights the past sectorial backgrounds as well as the educational background of the CFOs chosen for the job.

Figure 6 shows how well-experienced CFOs are the most preferred candidates, but a fifth of these opportunities are open to younger talent as well.

There’s also a region-wise split—with most of the highly experienced CFOs concentrated in the western part of India (see Figure 7).

Besides the CFOs office, Native also spotted an interesting trend of robust demand for corporate development and M&A teams to tackle aspects such as fundraising, investor relations, and strategic growth (see Figure 8).

The future is full of possibilities

Choosing the right CFO talent to lead the IPO proceedings, with varied experience, an in-depth understanding of investor expectations, and intuitive leadership qualities are must-haves in a CFO-of-choice. Given the increasing number of companies that want to leverage the current business landscape and make their public debut, the future is indeed replete with interesting opportunities.

Expert views

Sandeep Kher

Director, Sequoia Capital India and South East Asia

“An IPO is still the holy grail and amongst the most important milestones for a company! The task of preparing a company for its IPO, or a special purpose acquisition (SPAC) falls largely on the CFO and S/he is integral to making this a success!

The role of a CFO, especially in hitherto private companies, is going through a significant evolution with a greater list of responsibilities as the company scales and gets ready for the public market.

I think what is key for a CFO is not necessarily having prior experience in listing, or even extensive knowledge of the process, but a prepared mindset. It is essential that the CFO starts to lay early foundations for an IPO/SPAC by identifying which functions or capabilities need to be built up internally – and thinking through each and every step in the lead up to the bell ringing.

The period before an IPO is a tsunami of activity, emotions and challenges. The CFO has to ensure that the organization not only has a strong finance team, but also the right capabilities & infrastructure to make this major transition successful. It’s critical to align with core people within the organisation, both inside and outside of the finance team.

Most importantly all of us should remember that an IPO is a milestone in a long journey, and running a public company is much harder. While a lot of real work happens in the lead up to the IPO process, the rubber really hits the road in that first quarter after you’re public.

Going forward, India needs more public company CFOs to share tribal knowledge with their peers, as we are on the cusp of seeing many more private companies go public in the future.”

Venkat S.

Founder, Practus

“CFOs taking their companies public have an added (and sacred!) responsibility of protecting minority shareholder interests. In general, public shareholders require more transparency, forward guidance, more detailed analysis and explanation of business performance, in relation to existing institutional investors like PE/VC funds. The trade off between providing this visibility while dealing with the ever present challenges of business uncertainty and the need to protect competitive information is a delicate balancing act expected of CFOs. Taking a company public also demands significantly higher levels of articulation and stakeholder communication from the CFO.”

Rajeev Newar

Group CFO, RK Swamy BBDO Group

“IPO journey is a roller coaster ride where we need to keep calm and eyes wide open.

Usually, the tools and technology for the finance and compliance function in a private company are not given the same importance as in a listed company. This transition needs intense planning, speed of execution and internal engagement for a seamless transition. Lack of tools and technology can slow down if not cripple an organisation’s IPO dream.

The IPO process is so intense that the team can often break down. The morale has to be kept high at all times. Delegation with clarity of purpose and a non-intrusive review process is desirable. CFOs leading an IPO need to have the ability to connect with their teams at all levels.

This is not just a mere transaction but a change management journey. The touch points are every function though the finance and secretarial team end up with the heavy lifting as the laws for a private company is relatively relaxed and very stringent for a listed company. Hence the CFO who leads this transition cannot be an accounting CFO but a Business Partnering CFO who has the ability to see the big picture. An IPO is performing on the Big Stage.”

Mandar Pramod Dixit

AIR Rank 1, Reliance Industries / Ex Infra.Market

“The toughest job in India is being a CFO of a startup that is about to get listed.

Wondering why so?

1. It’s important that IPO-bound startups hire a CFO and other relevant CXOs with relevant backgrounds and experience across domains at least 1.5 years prior to the listing plan and start working like a listed entity. For e.g. Monthly Book Closure, IFC, Quarterly Results, Accounting Policies, Governance compliance, Related Party, Board rejig, Investors Communication etc.

2. The losses cannot remain forever-growth in topline and bottomline is what street looks for. The challenge is to provide returns to shareholders from the astronomical valuation at which the startups might get listed-not talking about listing gains. A CFO has CFO great role to play here.”