“HISTORY CREATED! Sensex touches 60k for the first time ever”

It’s an exciting juncture for Indian markets with investor interest on an all-time high. All thanks to the reopening of businesses, and a surge in global markets. Plus, a tectonic shift in the global investment landscape with India turning out to be a favoured investment destination.

Ironically, while the investor interest is in green, the investment banking industry in India is finding itself in red, not because of a lack of business but because it’s crippled by a talent crunch.

Exodus of talent in IB

Once one of the most coveted and sought-after industries, a career in investment banking meant power, prestige and panache—a heady trio for young bankers who eyed working in investment banking for achieving their professional goals and lifestyle dreams. It meant rubbing shoulders with the who’s who in the industry and surrounded by a sea of overachievers. Not to forget, huge financial benefits in the form of heavy pay-checks. Indeed, a few years of this and one is far in learnings and earnings.

Yet, over the last few years, the industry has been shrinking. While a high-stress work environment, long hours and a lack of work-life balance have always been there, repetitive tasks, tough deadlines and the absence of a nurturing work culture added to the woes.

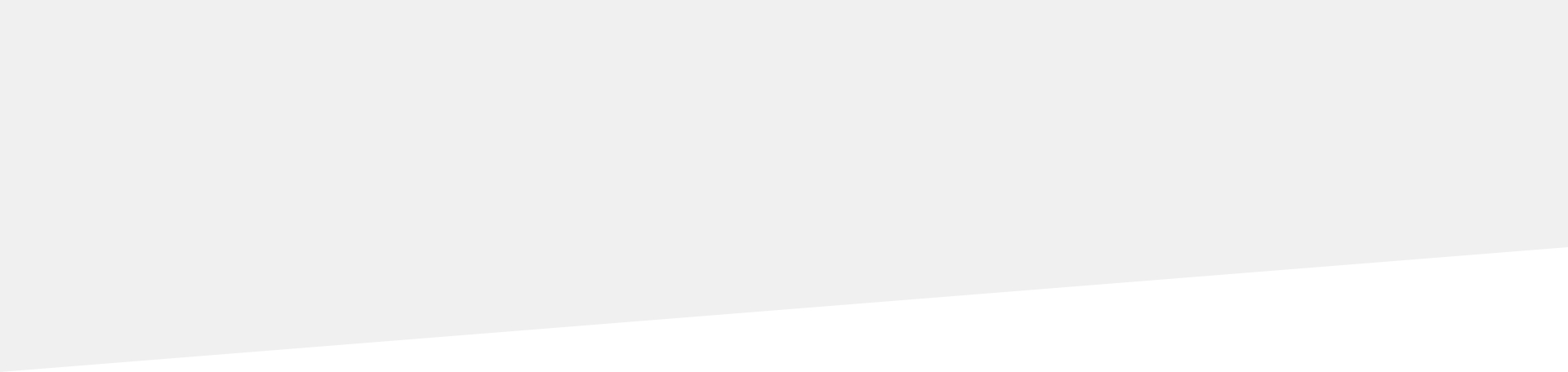

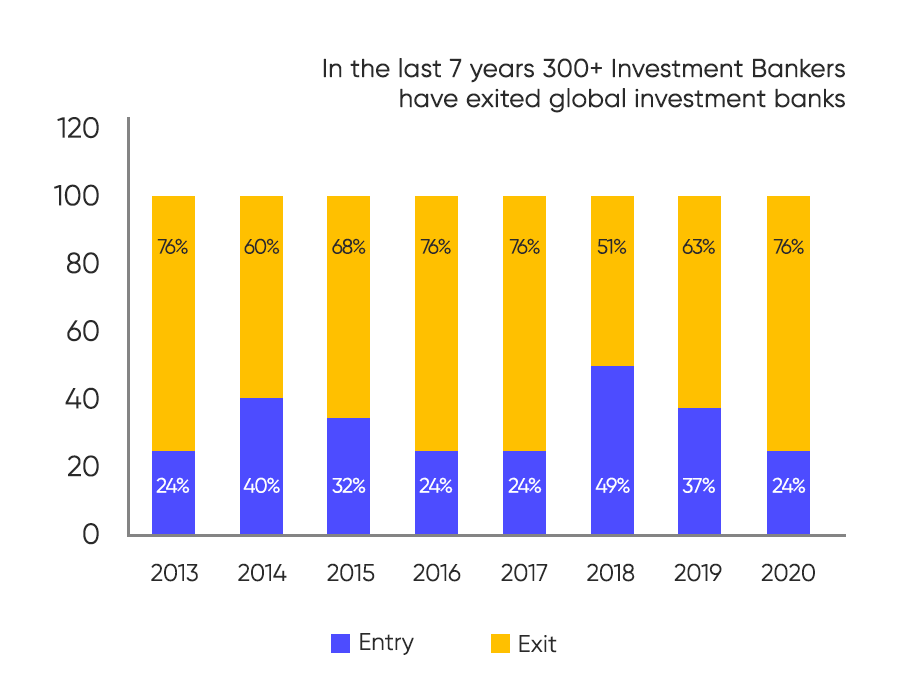

Native’s analysis, based on the talent movement from some of the top global investment banking firms in the last few years, supports the inference (see Figure 1). More than double the exits as compared to lateral hires.

Figure 1: Lateral hires Vs exits in global investment banking firms

Opt-outs – I don’t love it anymore

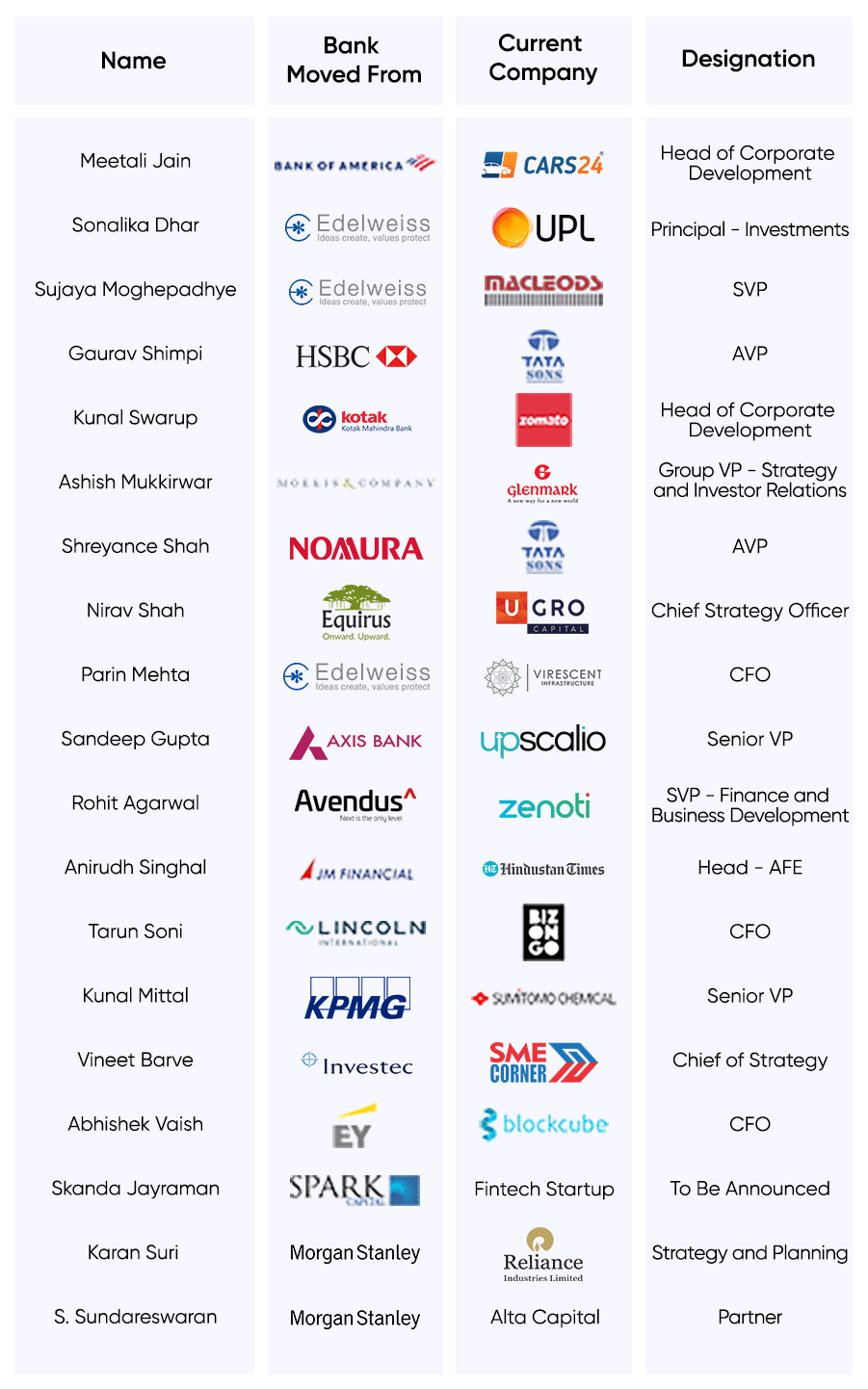

Many professionals have been opting out and actively look for opportunities outside the industry. From corporates to private equity firms and even startups ready to lap up this talent, the move isn’t difficult to make. The demand is also high in areas such as corporate development, finance, strategy and investor relations and it comes with a faster career growth, competitive payouts and ESOPs.

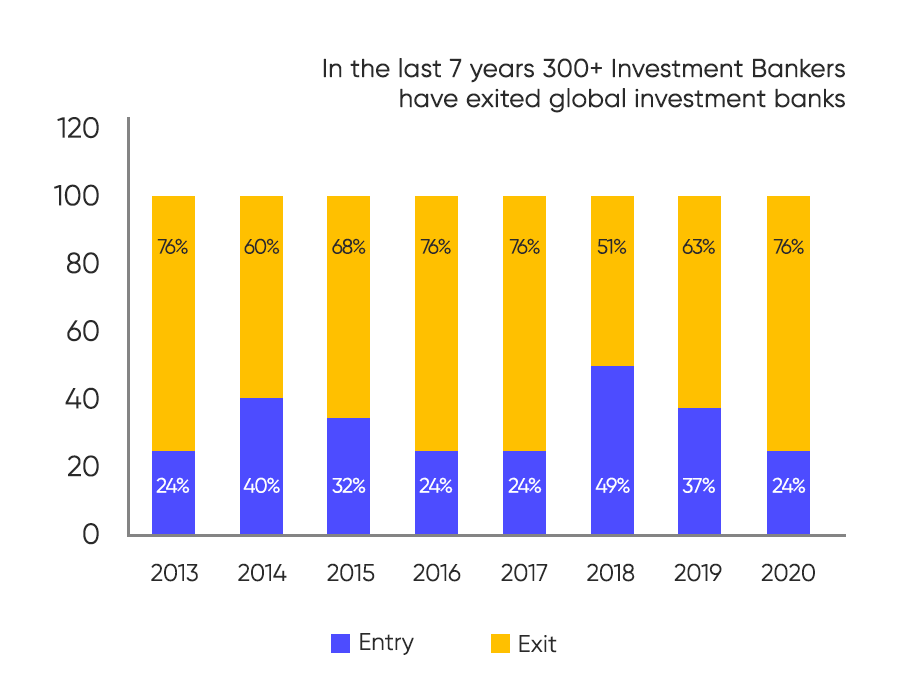

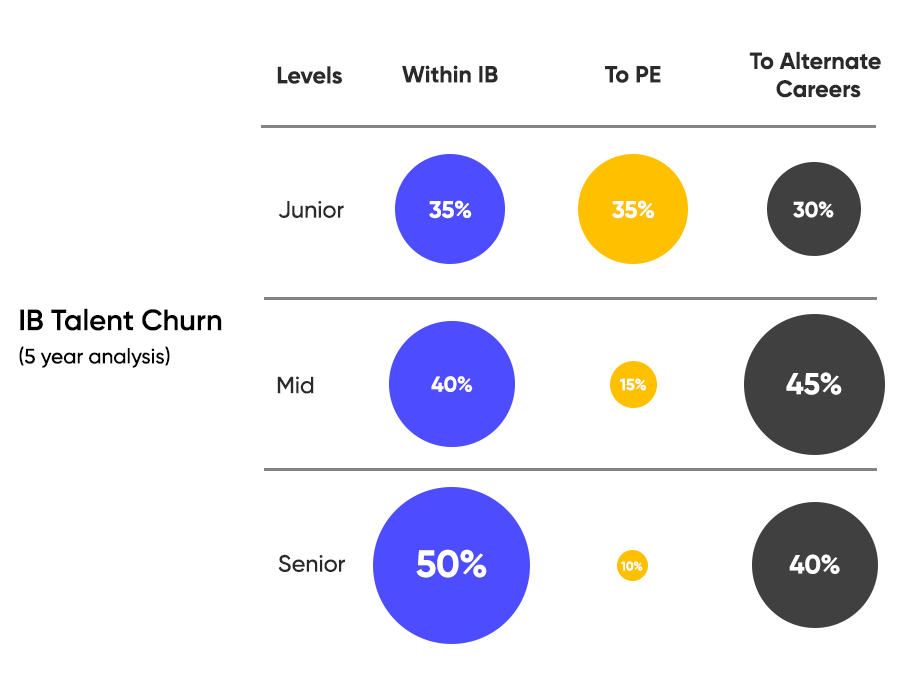

Figure 2 and 3 show a five-year analysis of bankers who opted out at different levels.

Figure 2: Talent movement from investment banking to other sectors

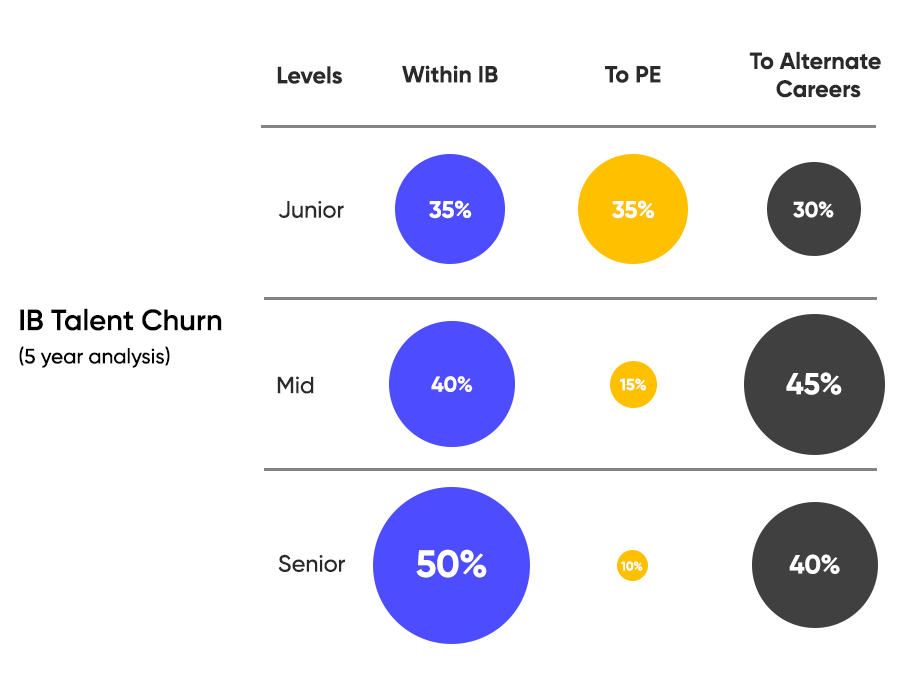

Figure 3: High profile moves from IB to other sectors

So, where does this leave the investment banking industry?

To begin with, on an urgent hiring spree across levels. Professionals from non-investment banking sectors, especially corporate and consulting talent, are also being welcomed into the fold. This, followed by an imminent change in its talent stratagem.

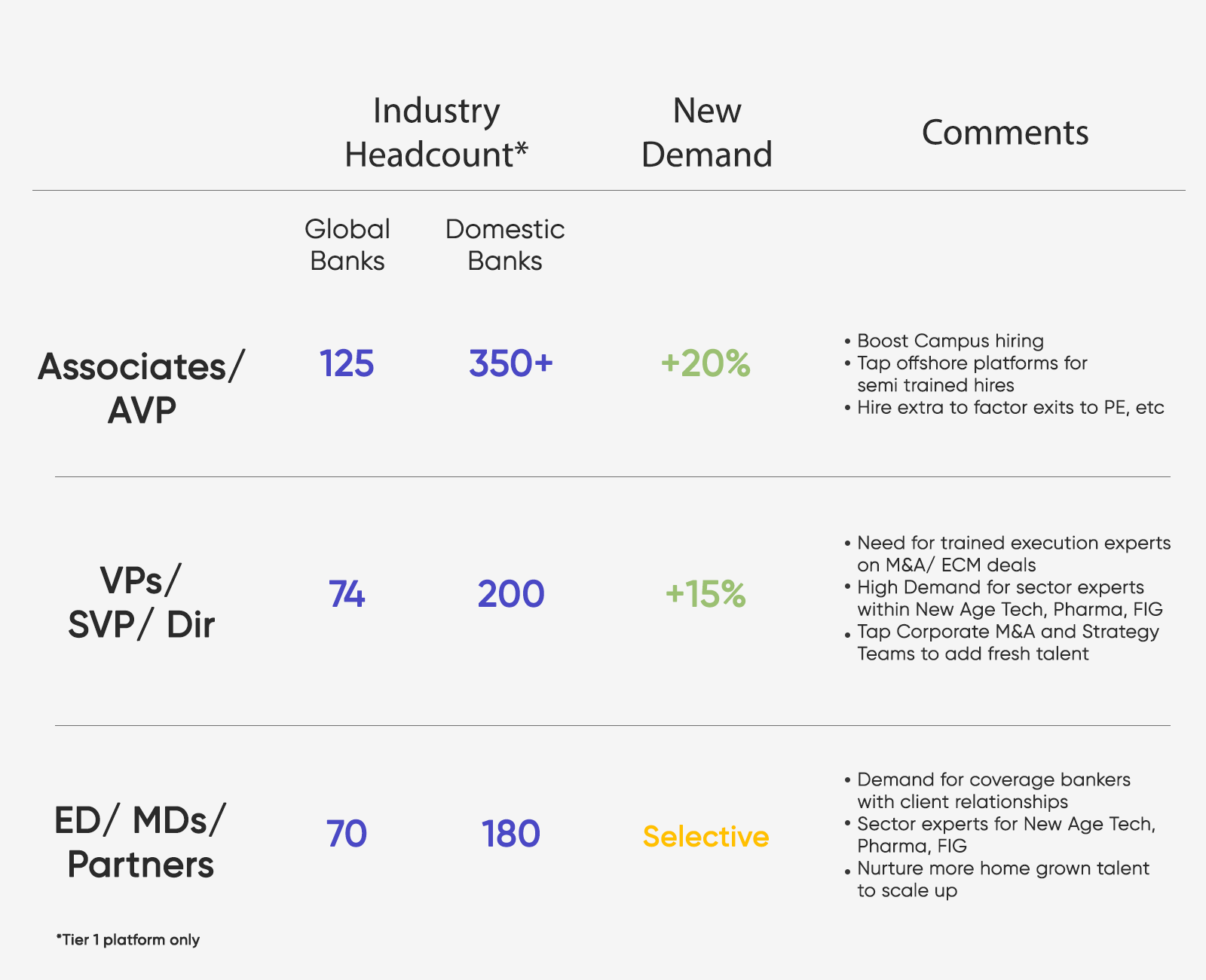

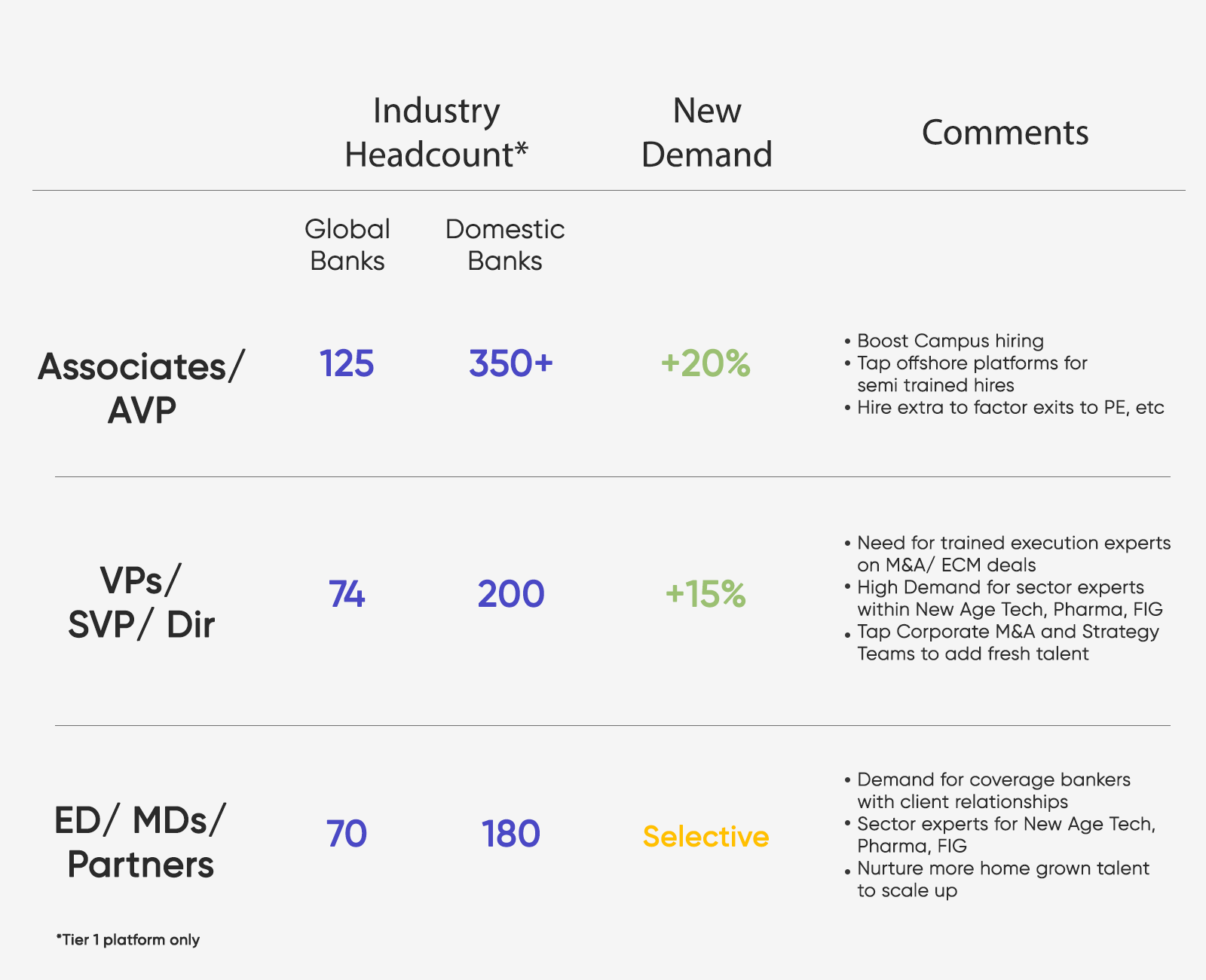

Figure 4: IB current talent scenario

The lesson is to broaden the talent base widely. With the high number of exits forecasted in any given year, hiring at the junior level itself must be expanded to make up for the predicted gap. Even if a substantial number of professionals move out in the future, the sheer numbers would help the industry survive.

Second, perhaps a fresh look at the talent-retention strategies. Clearly, the high-pay-but-high-pressure, exciting-peaks-but-constant-stress work environment has not won out in the end. Given the nature of the industry, it may not be the easiest puzzle to fit, but the IB industry definitely needs to take some measures for creating lasting careers.

Until then, investment banking firms will be buying high and selling low.