The Wealth Management Industry in India has evolved at a very fast pace. This has led to a growing need for a vast talent pool of private bankers if the sector is to capitalize its true market potential.

Native teamed up with Money Management India, a research-based media portal, for an in-depth survey of private bankers across the value chain. We spoke to people with varied seniority and professional experience (from relationship managers to leaders alike) on three fundamental aspects:

- What do the private bankers seek from the firms they work in?

- What do clients seek from a wealth management firm?

- How do private bankers envision the future?

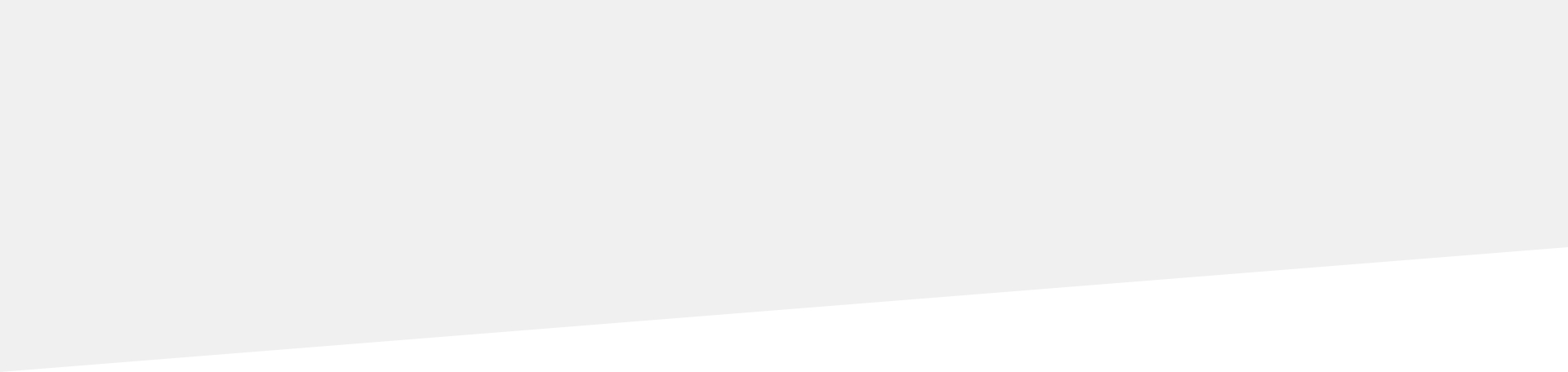

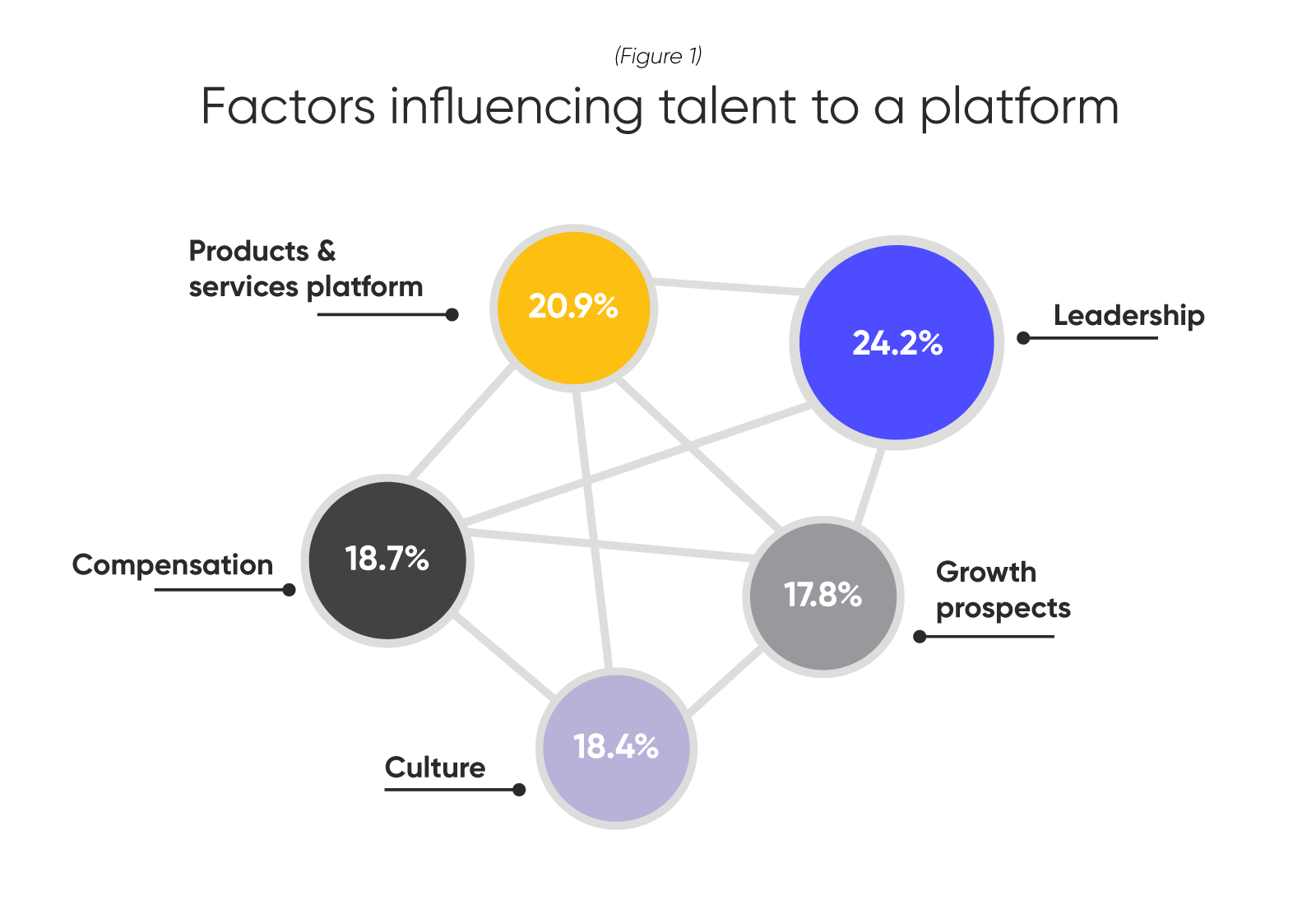

We started by asking the participants their observations on what do private bankers look for in a firm? Interestingly, strong leadership made the top of the list followed by products and services (see Figure 1).

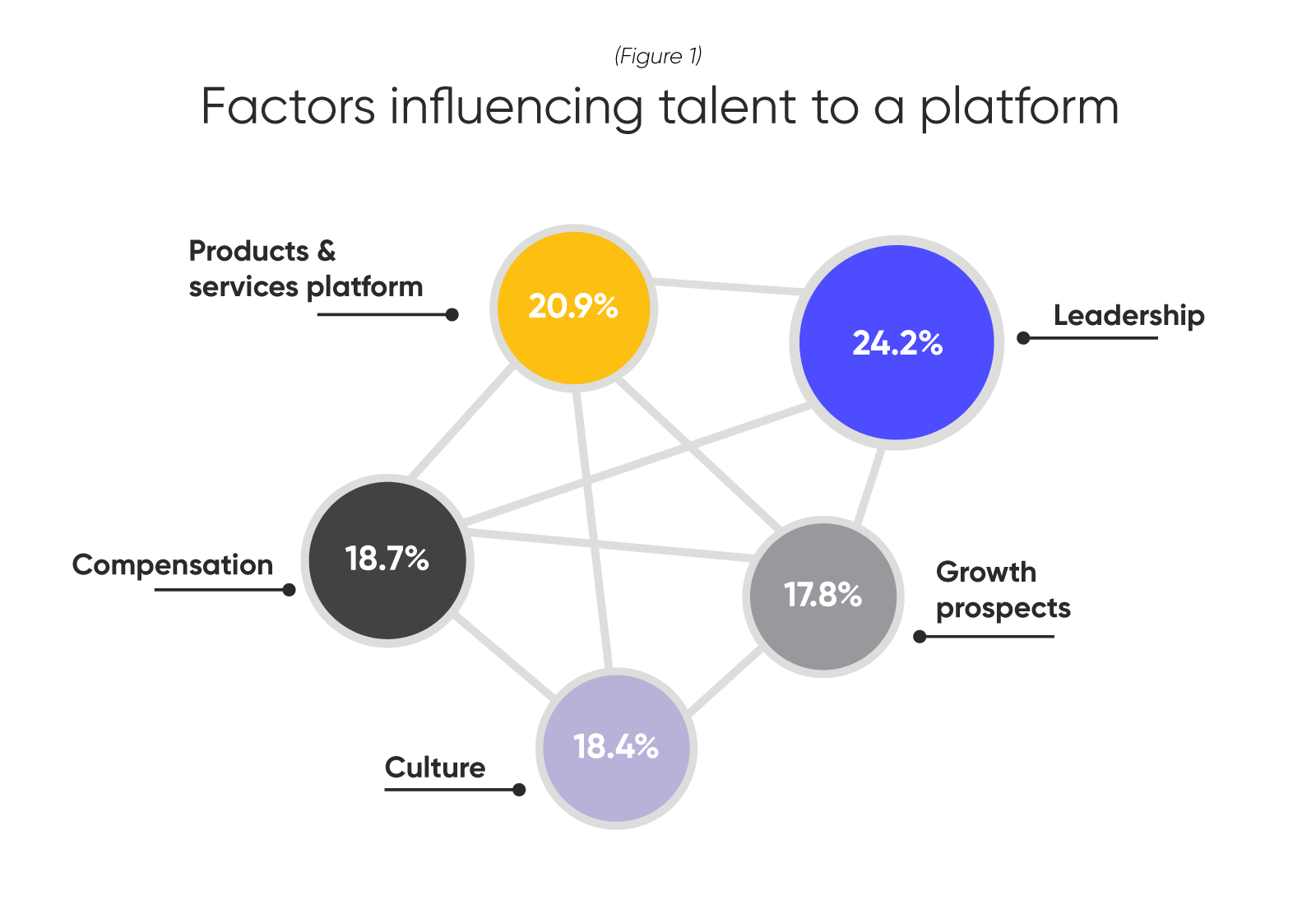

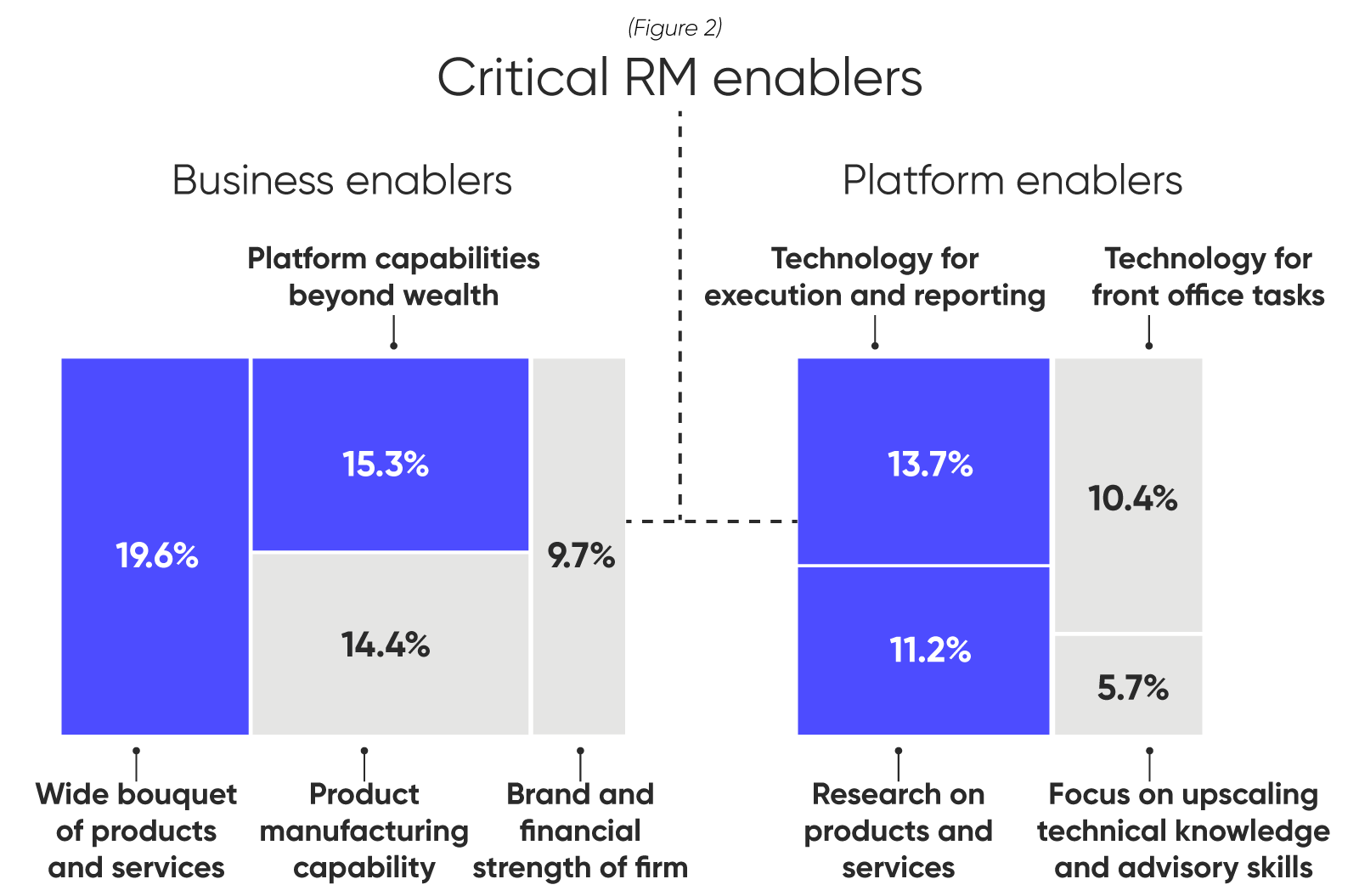

The next critical question: what are the key RM enablers?

The survey highlights the below mix of critical factors most important for a private banker to thrive,. See (Figure 2).

From a talent perspective, the Industry is firmly balanced on four pillars— formidable platform, technology, strong leadership, and a team of talented people.

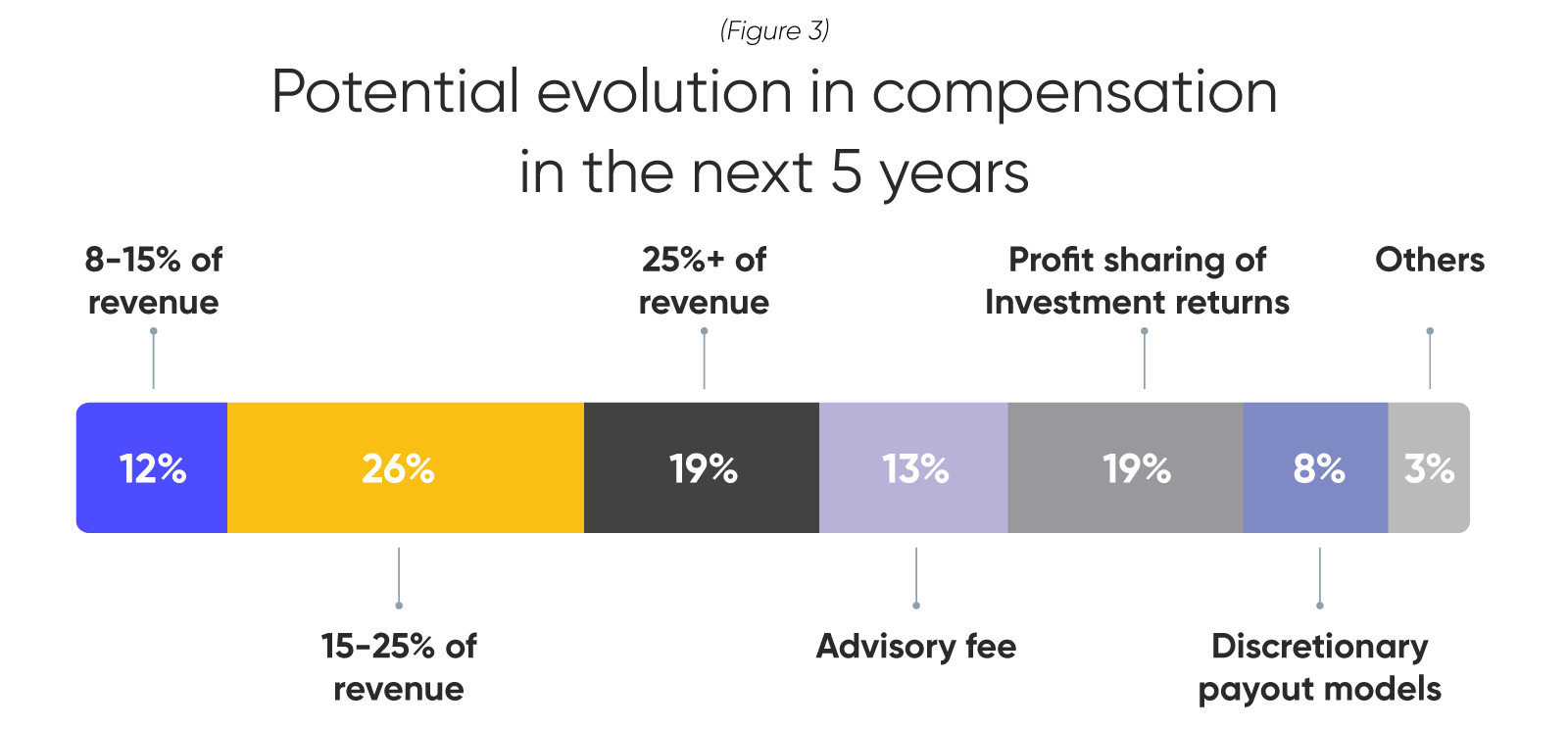

Compensation trends

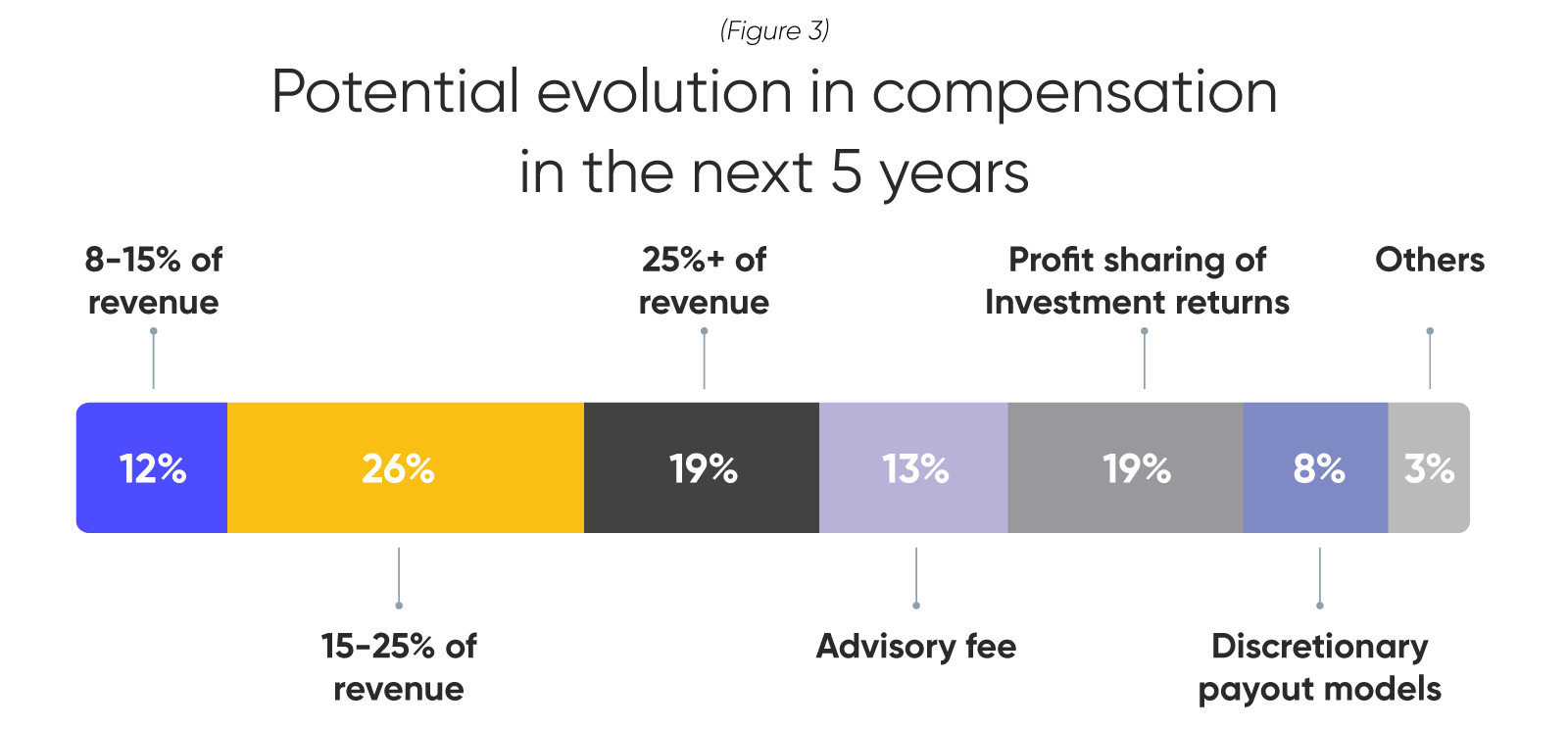

Majority of the respondents in our survey expect compensation in the range of 15-25% of the revenues, signalling a probable sweet spot for established platforms. (See Figure 3).

Interestingly, one in five respondents expected profit sharing on investment returns as an alternative to existing compensation models. Newer wealth management firms, however, are presently paying up to 40-45% of revenue as compensation. The CXOs who participated in the survey indicated such high compensation trends may not continue to sustain over the long-term.

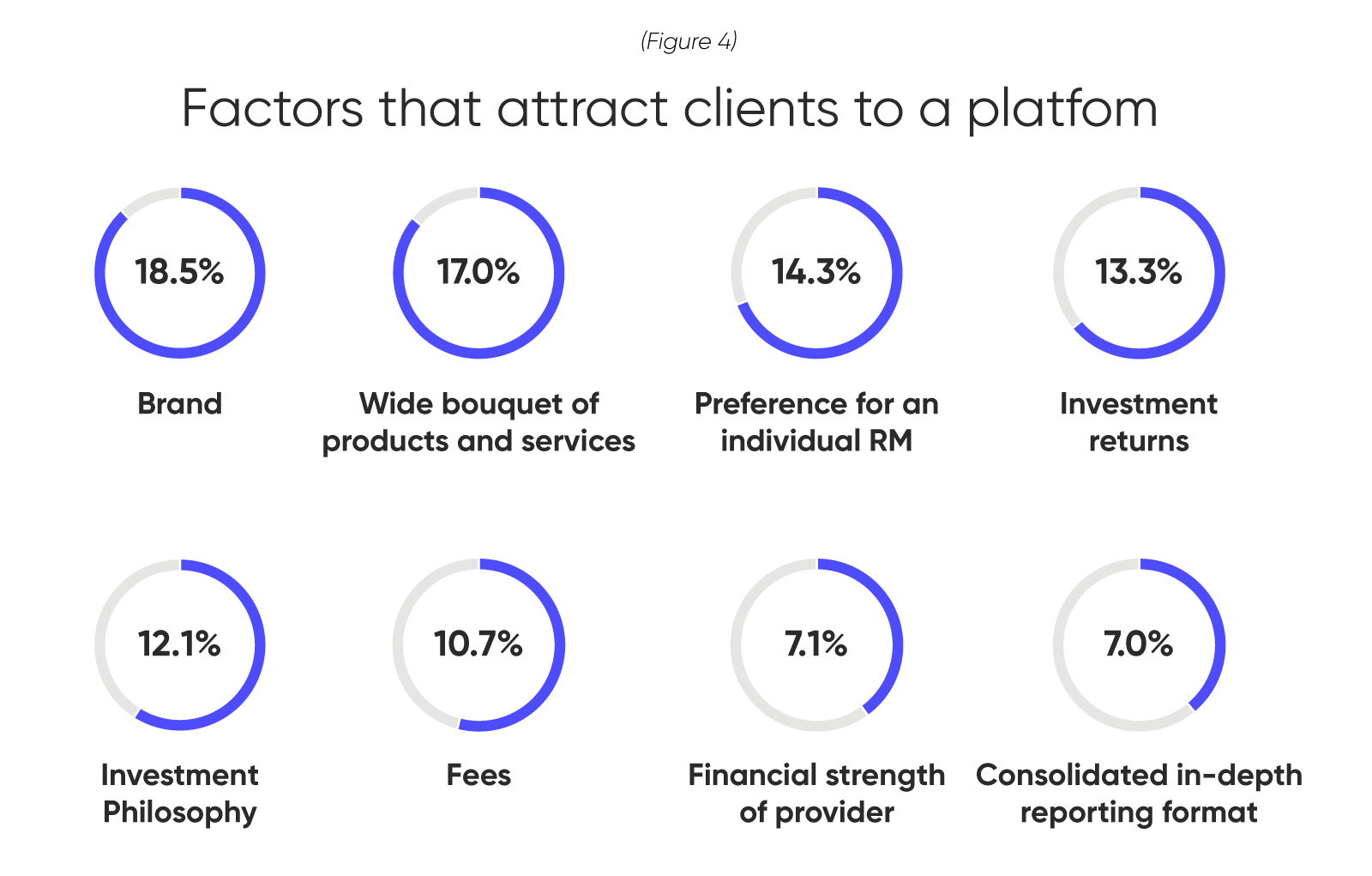

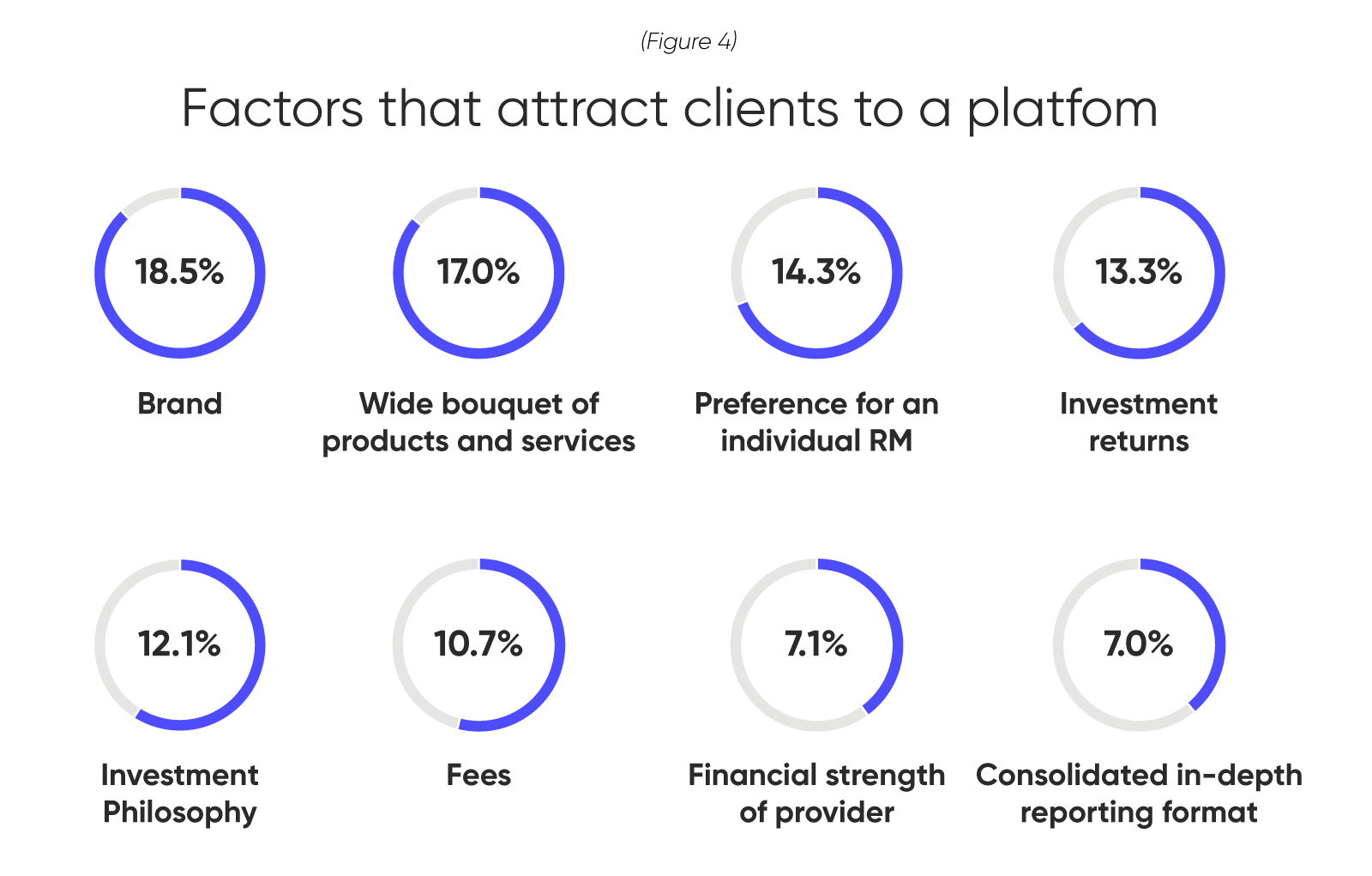

Now let’s look at what it takes to attract and retain clients? A trusted brand to handle their wealth portfolio followed by services, investment returns and professional fee (see Figure 4).

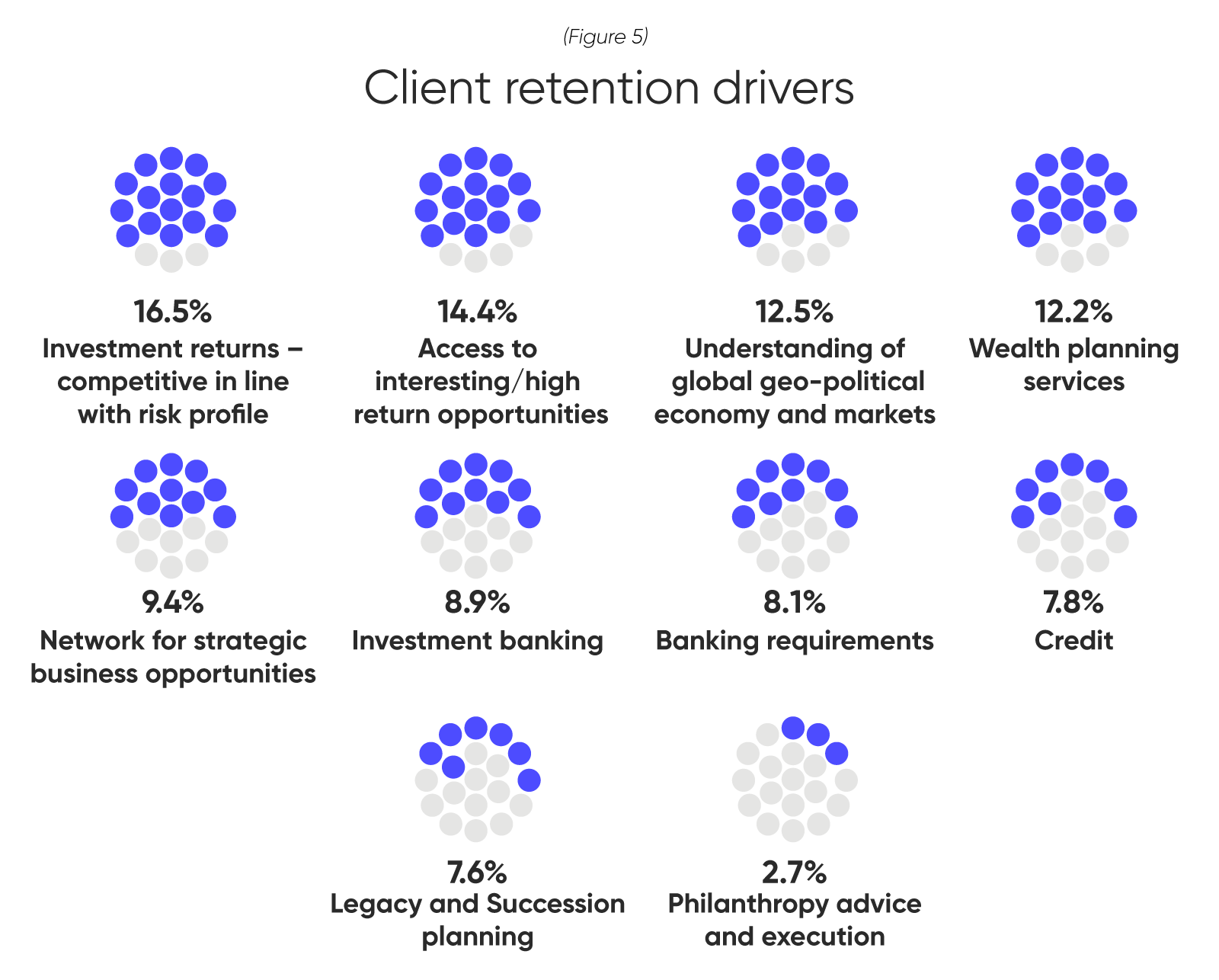

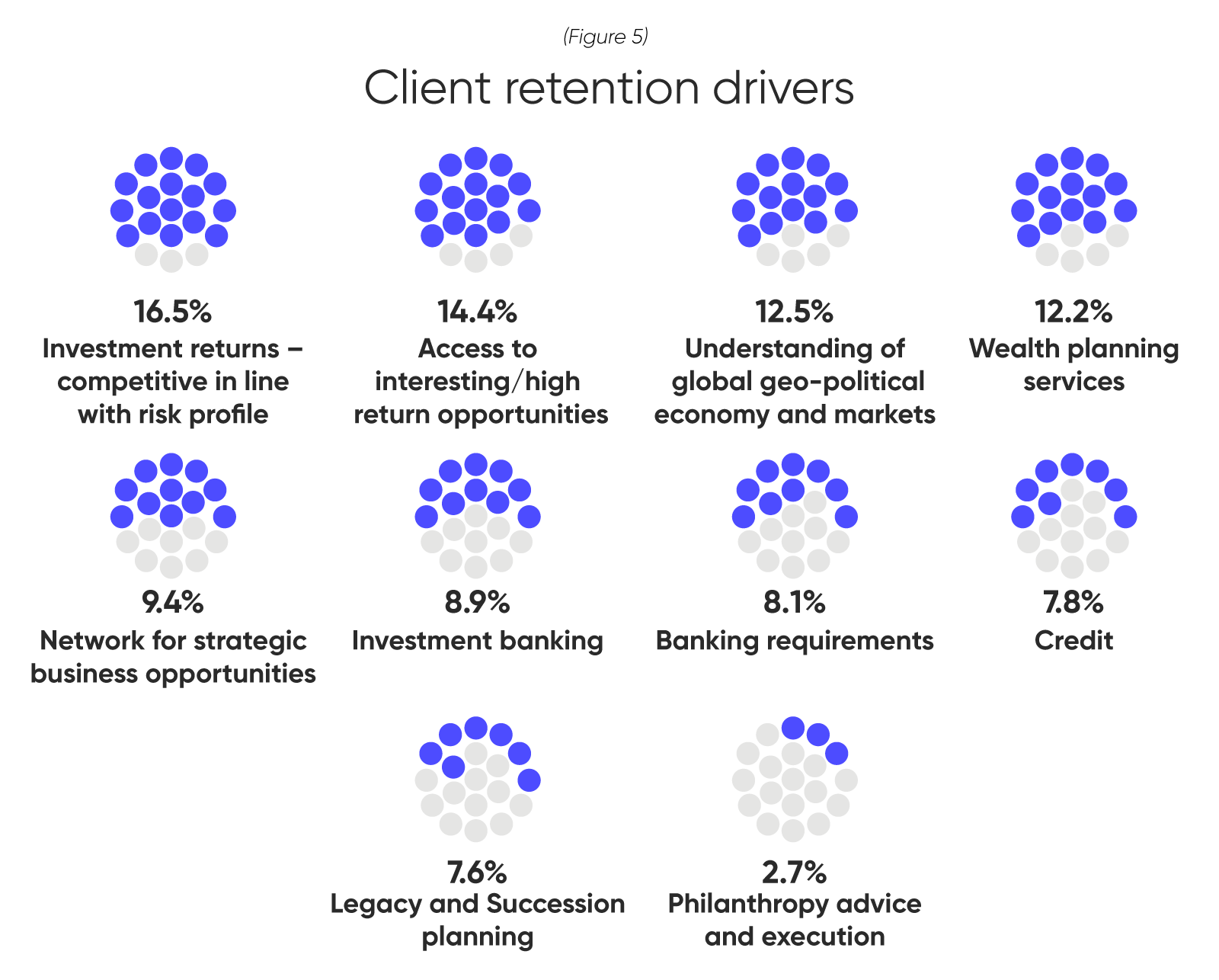

While the brand, platform capabilities and the relationship with an individual banker can attract a client, the participants indicated that customer loyalty is sustained—based on high investment returns with stable performance.

Interestingly, aspects such as professional fee or financial strength of the brand are not the decisive factors (see Figure 5). Clients are ready to pay and put their faith in a firm as long as it meets the bigger criteria on aspects like multiple unique investment opportunities and assistance in comprehending global geo-political economy and markets.

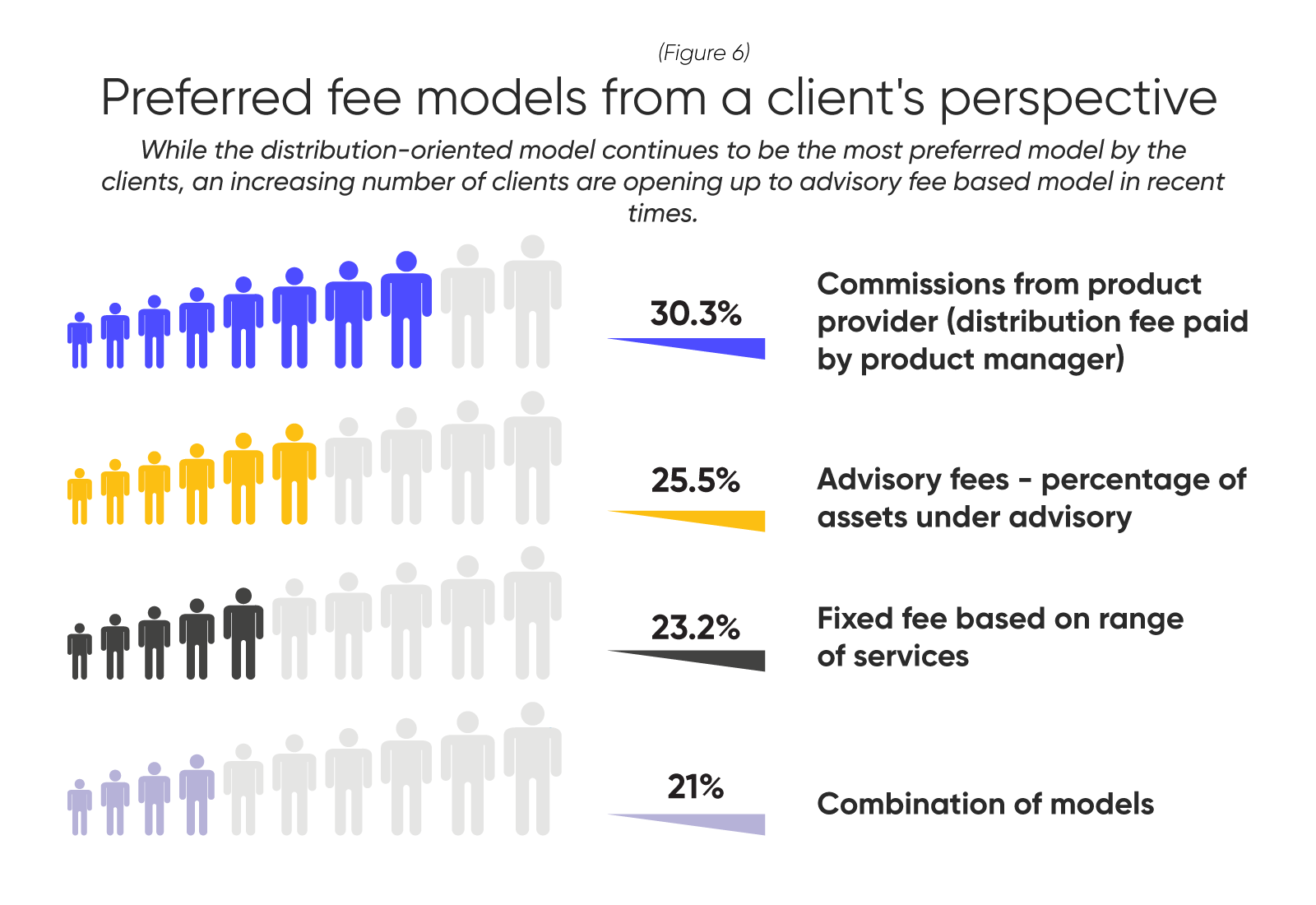

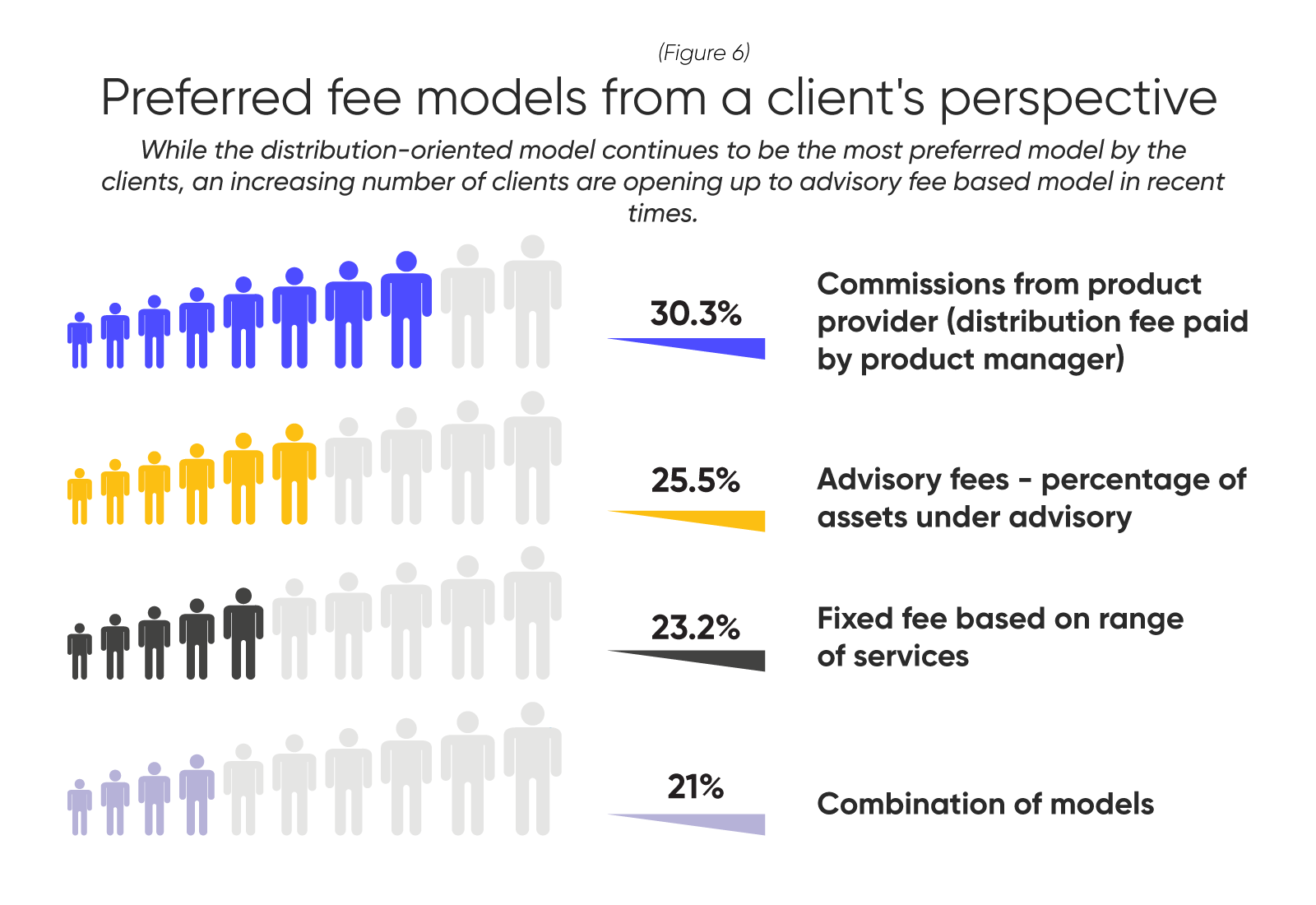

The group also shared their observations about changing preferences in fee models (see Figure 6).

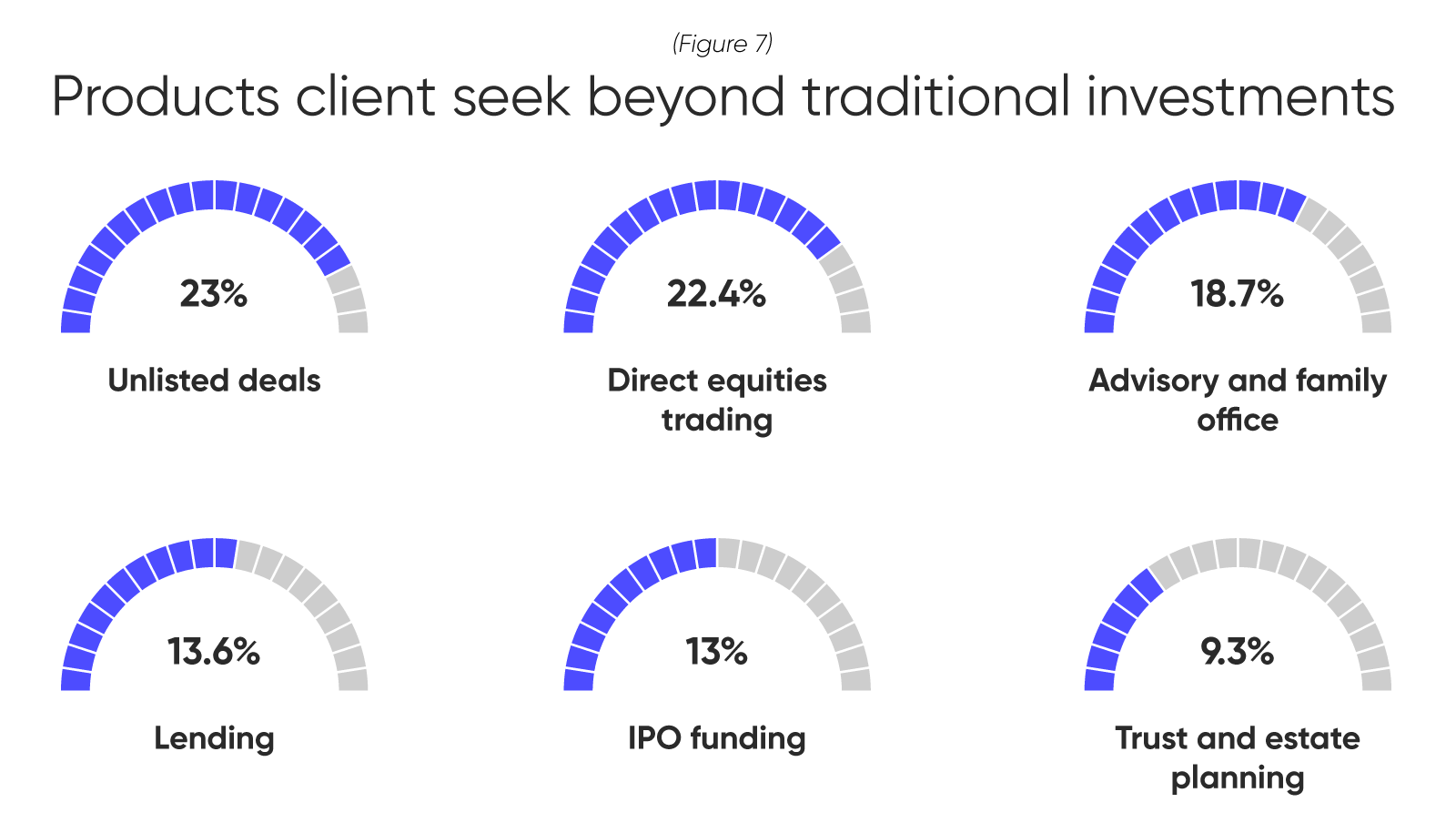

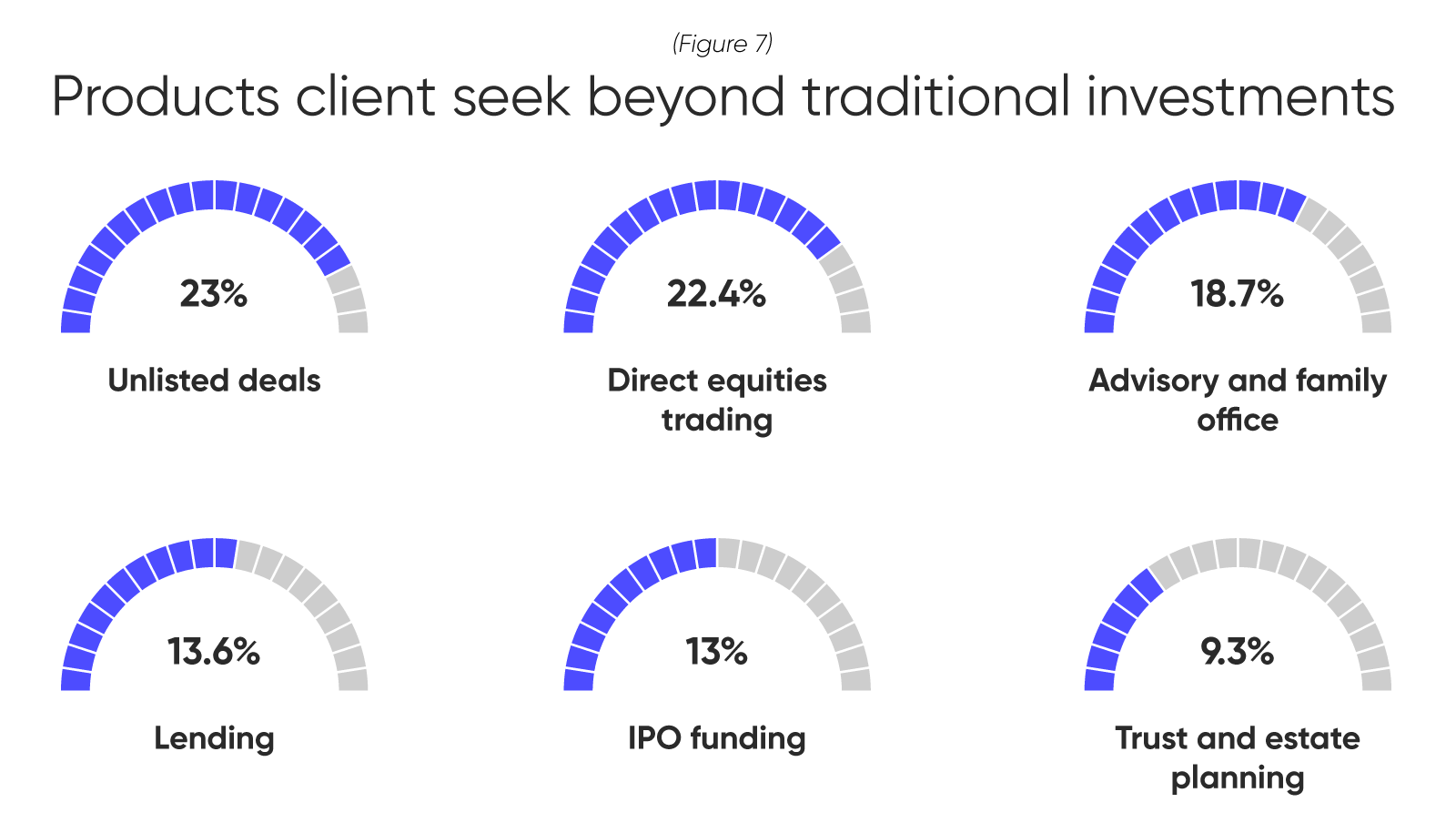

Similarly, there’s a bigger appetite for investing in newer avenues (see Figure 7). This indicates a strong impetus for integration of additional products (such as unlisted deals, direct equity trading) across platforms.

The Way Forward – With this we enter the last part of our survey which gives a foresight of what to expect in the future.

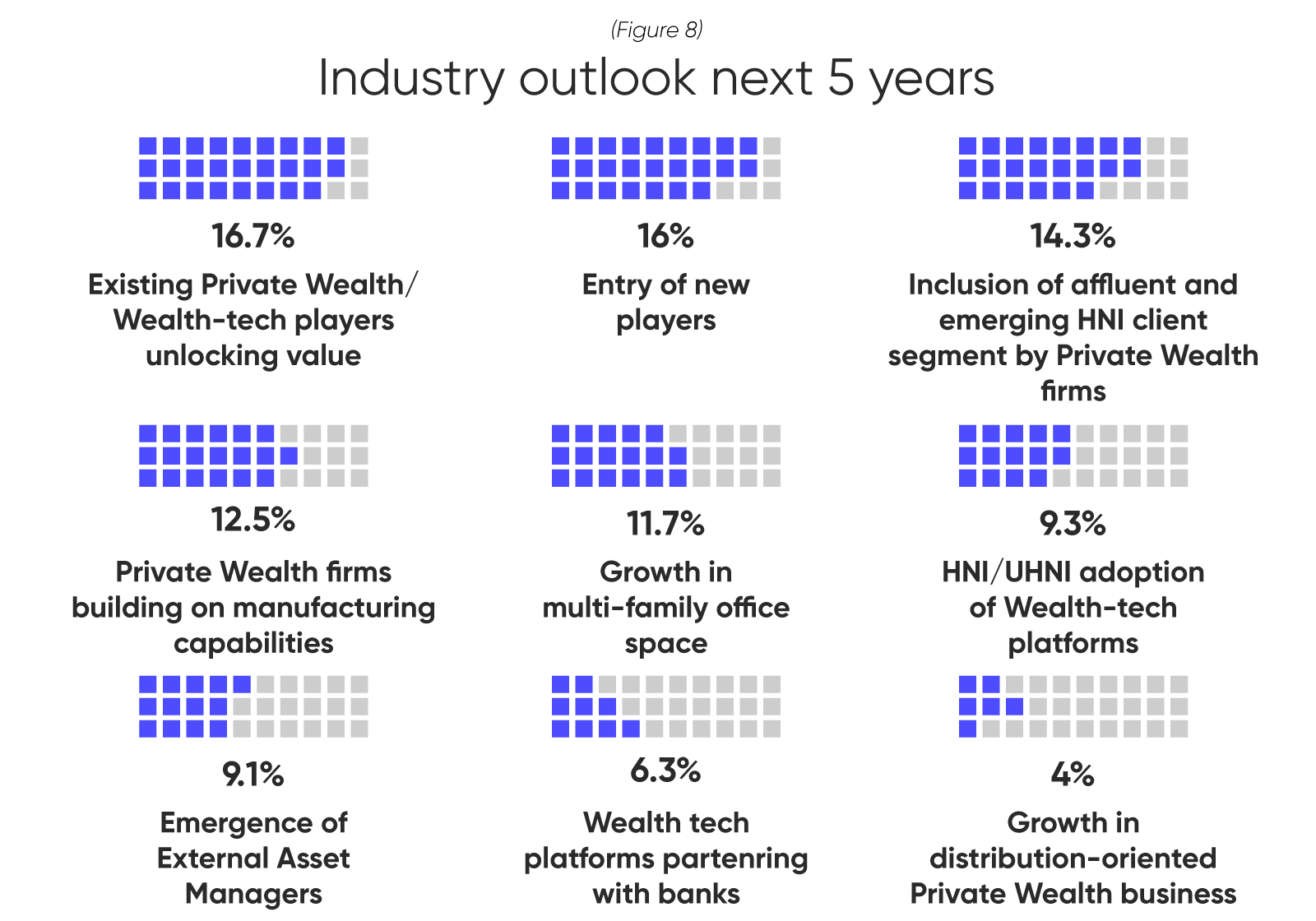

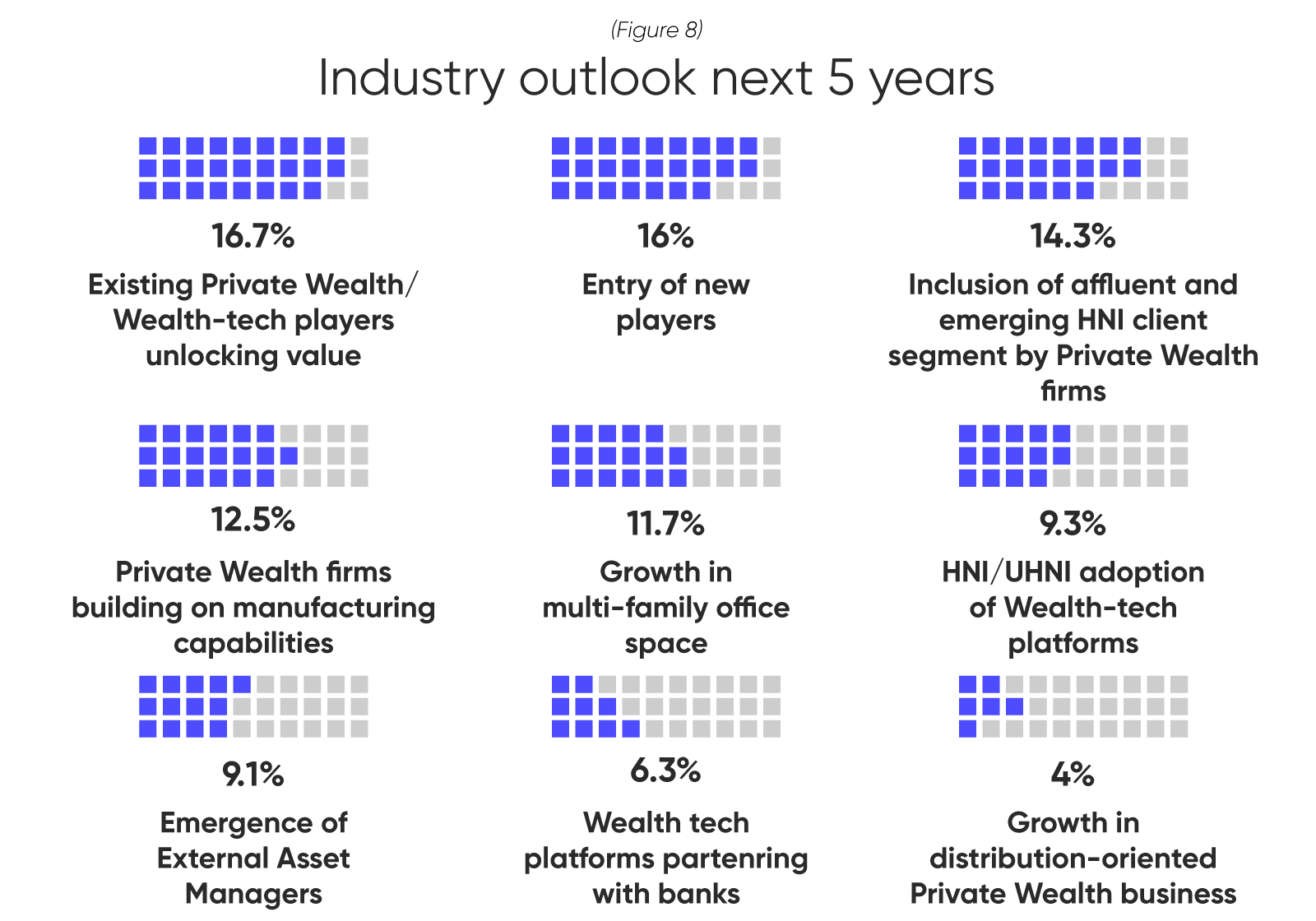

We expect to see existing private wealth players unlocking value, an explosion of new entrants, players widening their client segment and platforms building on their manufacturing capabilities in the private wealth sector in the next 5 years (See figure 8). Purely distribution oriented models may not see the same level of growth as witnessed over the last 2 decades.

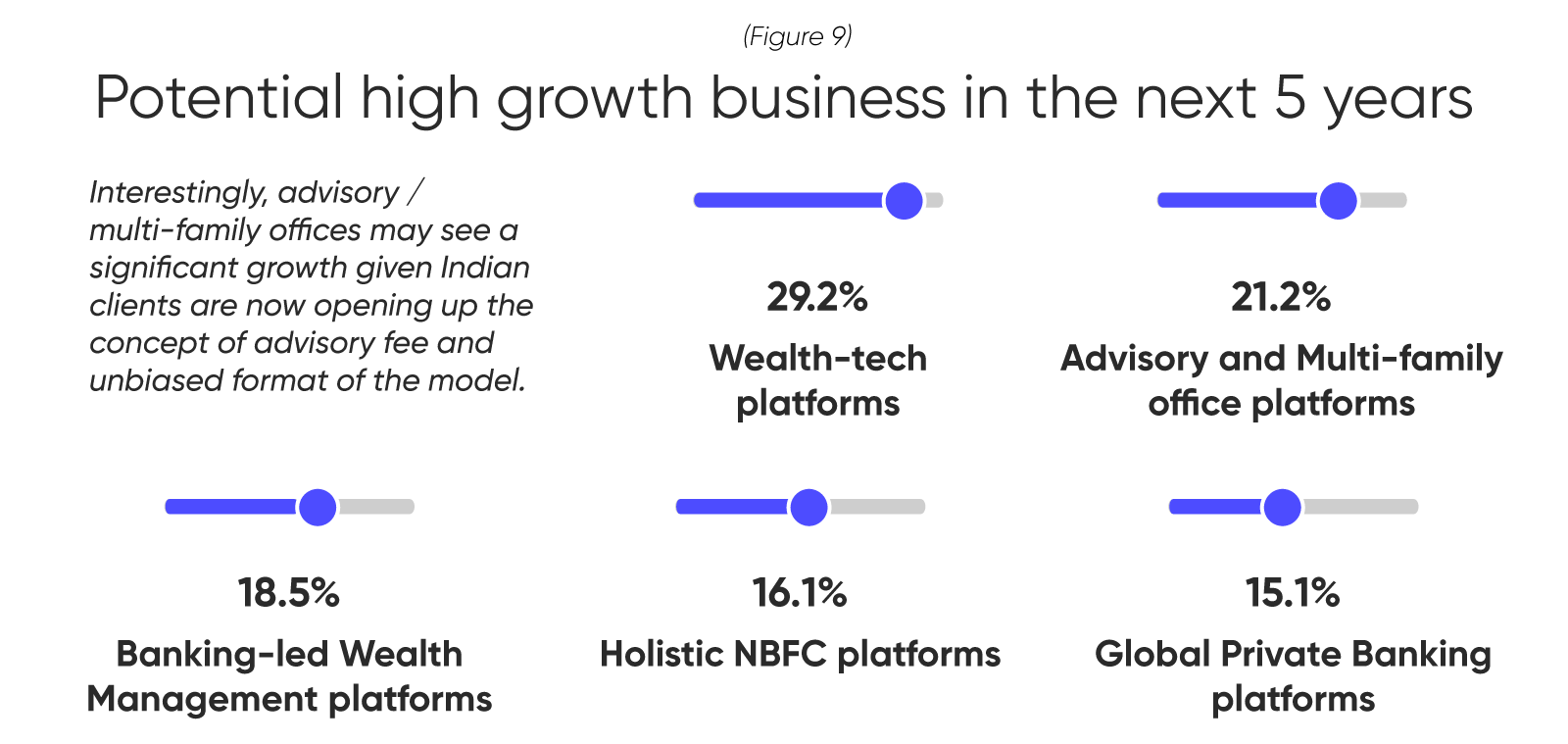

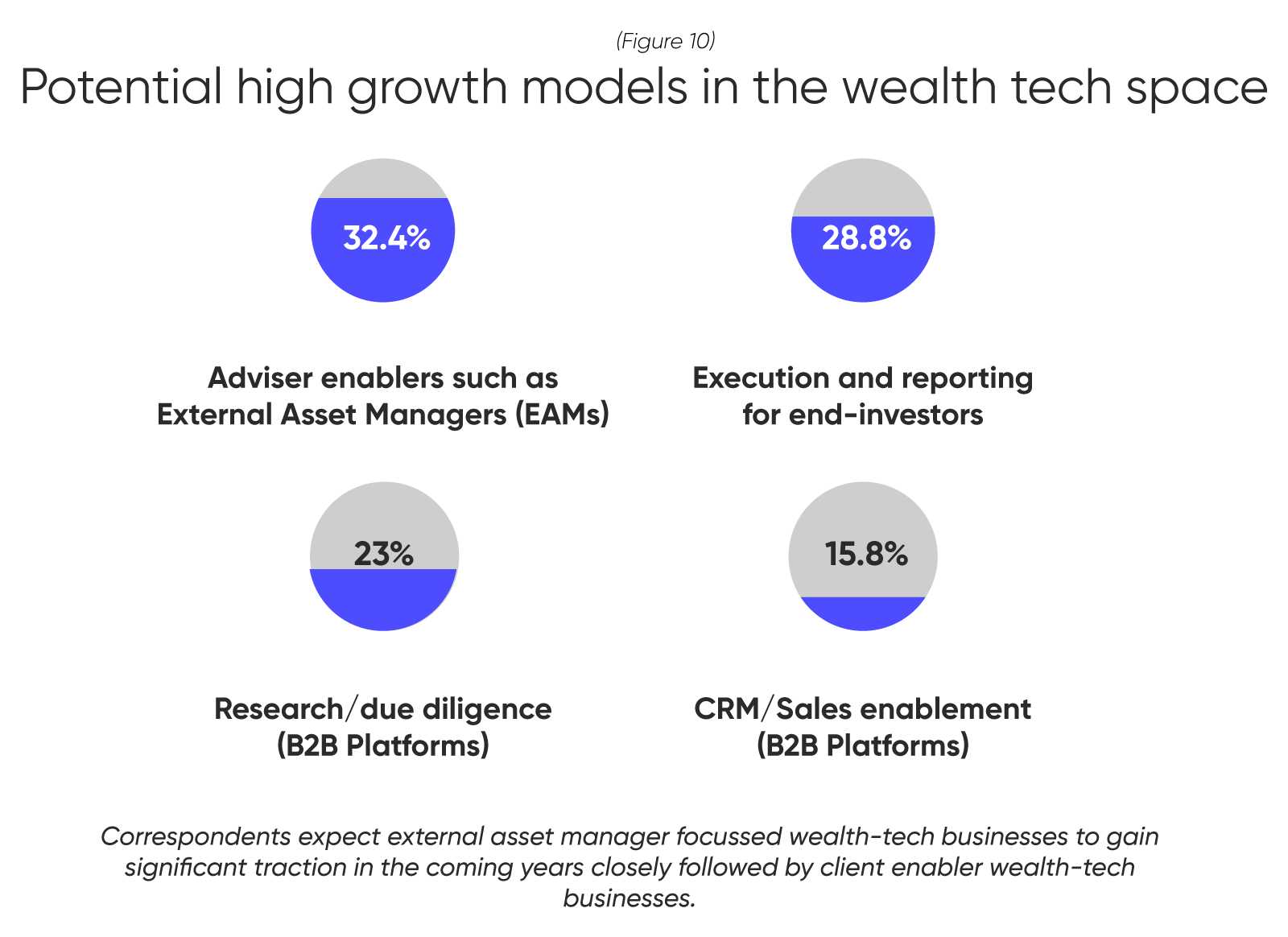

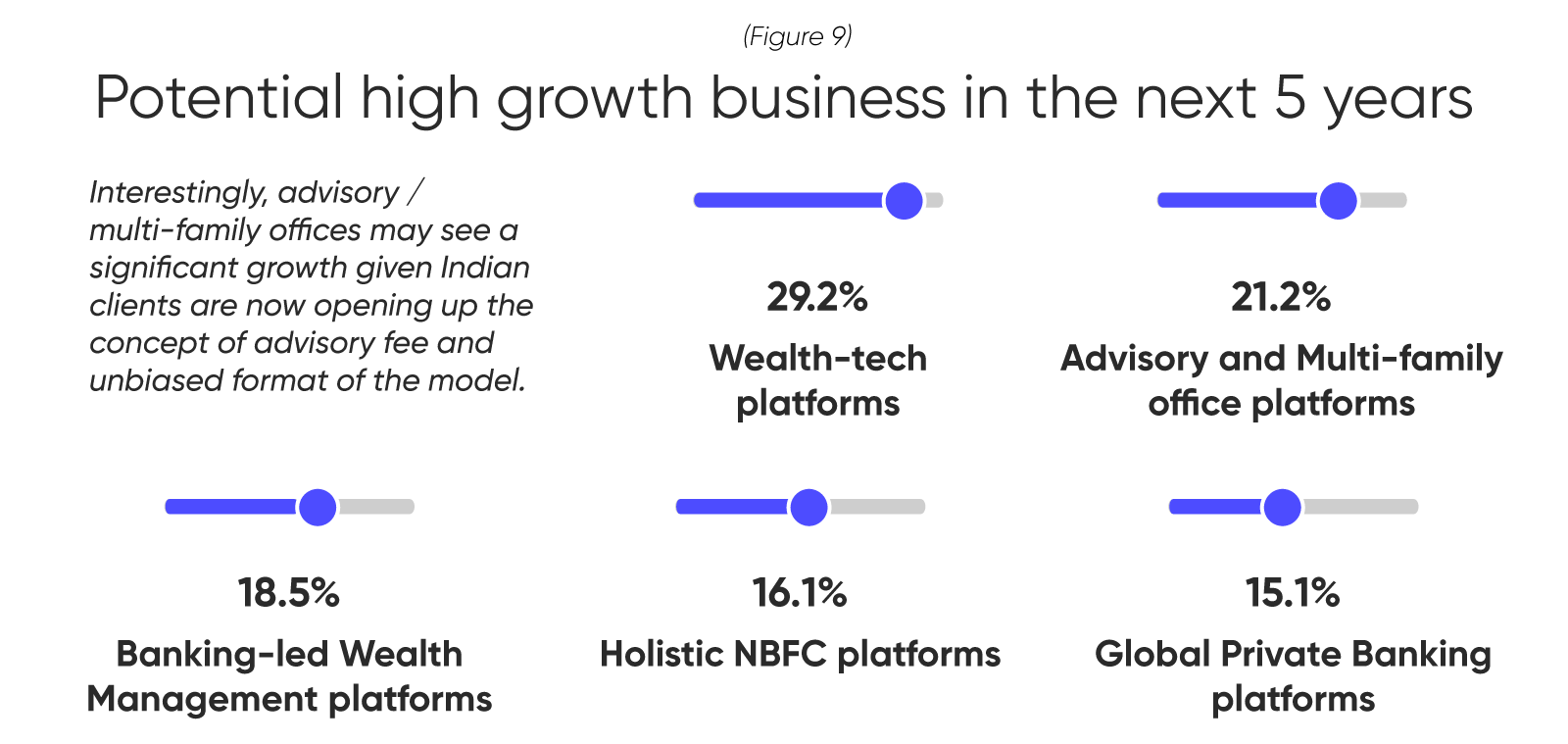

While it does require a mix of strategic investments in technology and talent, the benefits are impossible to ignore. Consider Figure 9 that showcases a highly optimistic growth potential of the wealth tech firms over the next five years.

About 30% of the survey respondents expect wealth tech platforms to see steeper growth curves. They are highly optimistic that the wealth-tech business will continue to scale and unlock value.

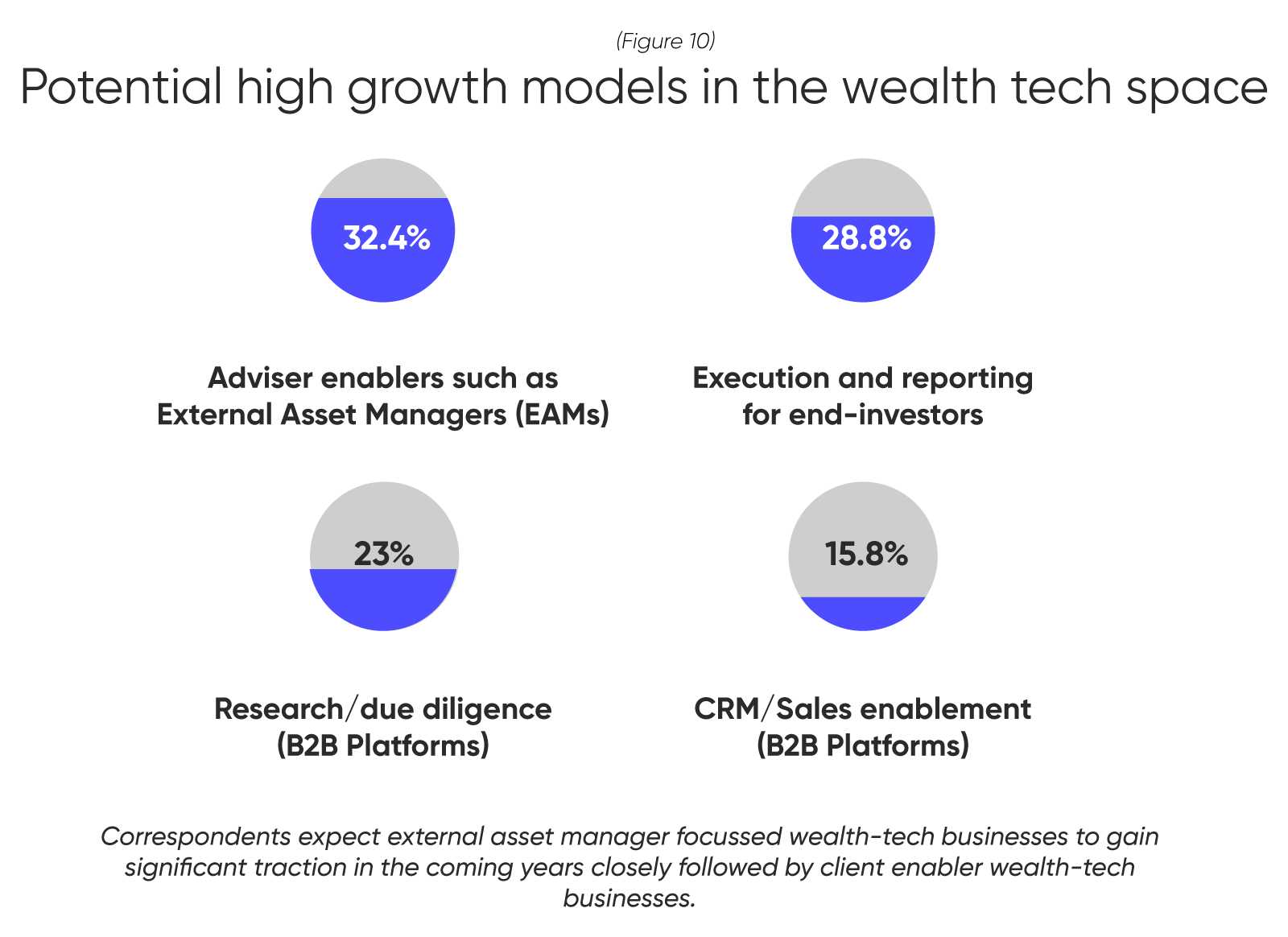

Similarly, the survey reveals an emergence of hybrid wealth-tech platforms which currently caters to largely mass affluent client segment. The HNI and emerging UHNI segment which is currently dominated by banks is gradually being allured by the hybrid wealth space firms.

Global surveys too point towards this new trend—HNIs and emerging UHNIs are not averse to switching to wealth services offered by Big Tech. Private Banks in Singapore, for example, are already reorganizing information flows to provide more connected services to their clients. Additionally, bringing in experienced professionals to run the show has ensured the right mix of functionality and marketability.

Embracing change—full throttle ahead.

The talent has spoken. The path is clear. The targets are set. The trend is only the beginning. The Wealth Management Industry in India is set for a long sail in business transformation and a robust talent demand. With the emerging trends of tech-enabled platforms, the traditional methods of doing business will witness a significant change. Is The Industry Ready?

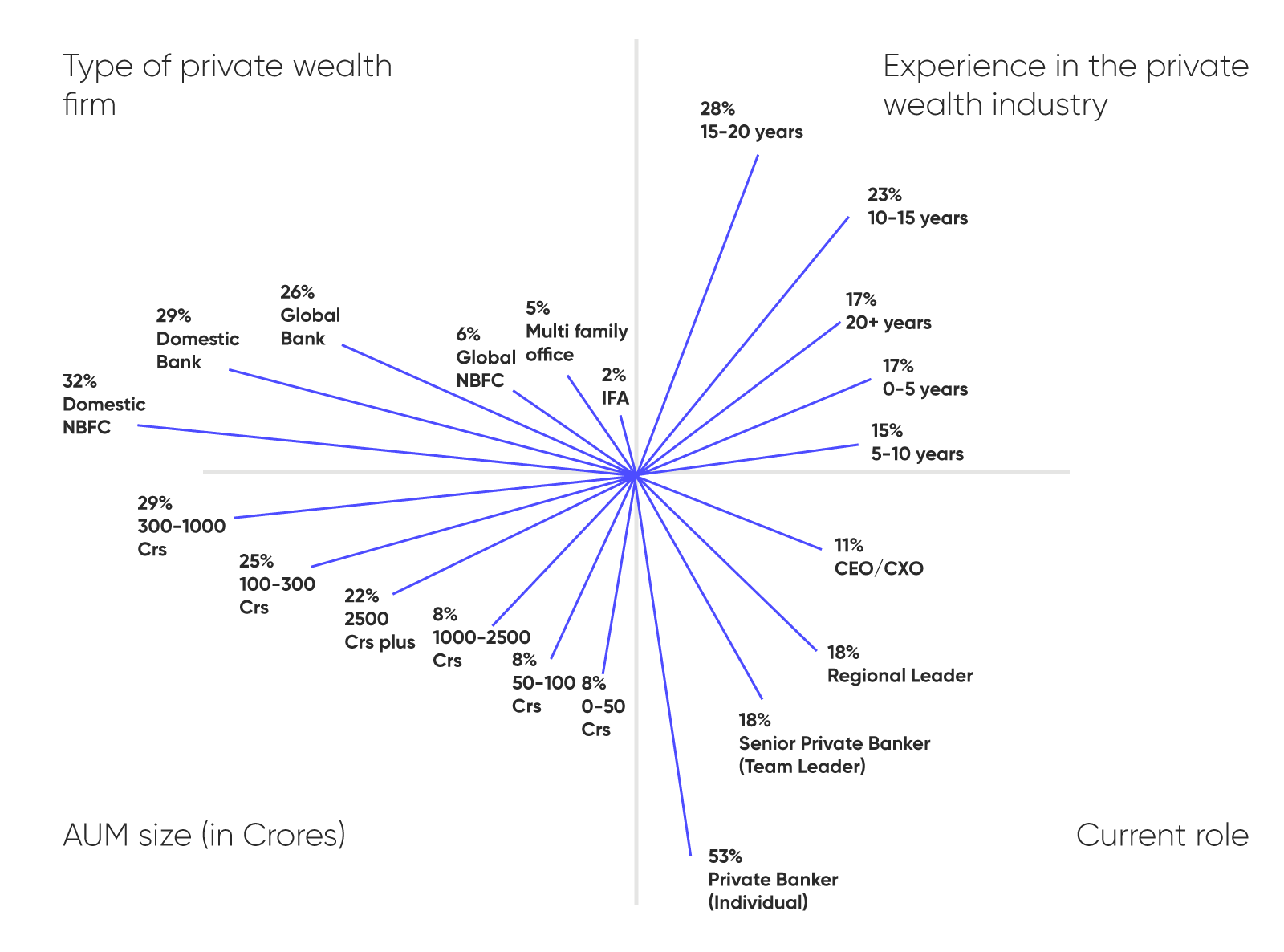

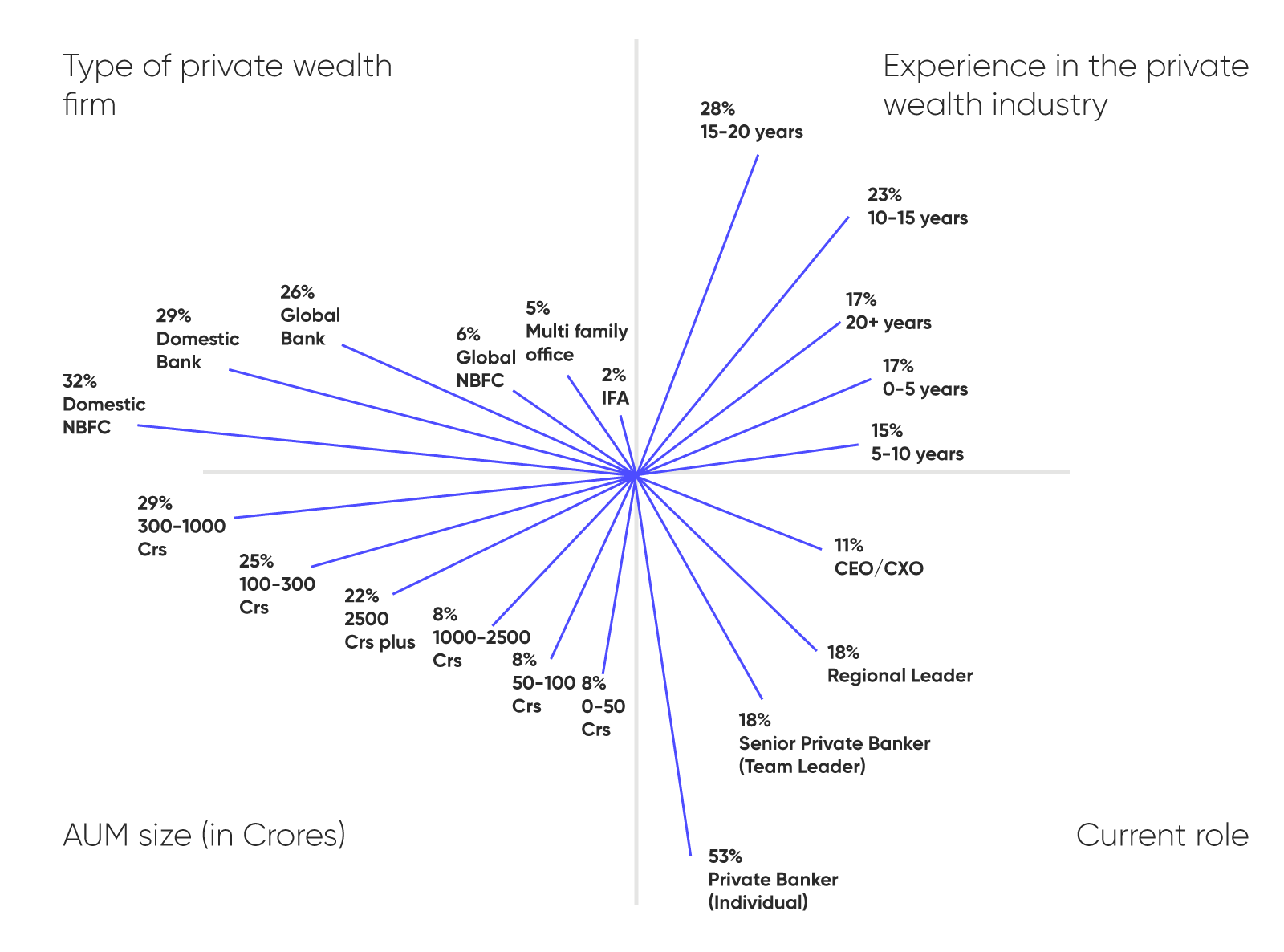

The primary participants of the survey were included from different stratifications of wealth managers and platforms as depicted in the graphs below.

Read full report on Indian private wealth industry here- http://www.moneymanagementindia.net/theprivatewealthseries