Welcome to the world of Young Turks in India Private Equity (PE) and Venture Capital (VC). Each year, there is a mad scramble amongst firms to grab the best undergrad talent from a selective pool of IB and Consulting. PE/VC Funds have turned their entry-level recruits into star talent, making them the most sought-after financiers around, with attractive pay packages and job profiles.

Stemming from a common trend in the West, where most undergraduates from various IVY League universities spend three to four years working on the buy side before pursuing further education, the trend is firmly set in India, too. Today, the PE/VC ecosystem of more than 150 firms, hires a massive number of undergraduates, each year.

Why really? To begin with, the firms get to hire the country’s best talent at a stage when they are eager to learn and easy to train. Coming from the most reputed engineering and commerce schools, the hires are easy to attract and there is no commitment to make them permanent recruits right away. Most importantly, the firms create a strong pipeline of high-quality, home grown talent, that may pursue further education and come back to the Fund ecosystem.

Native looked into some of the top trends in the career journey of these undergrads.

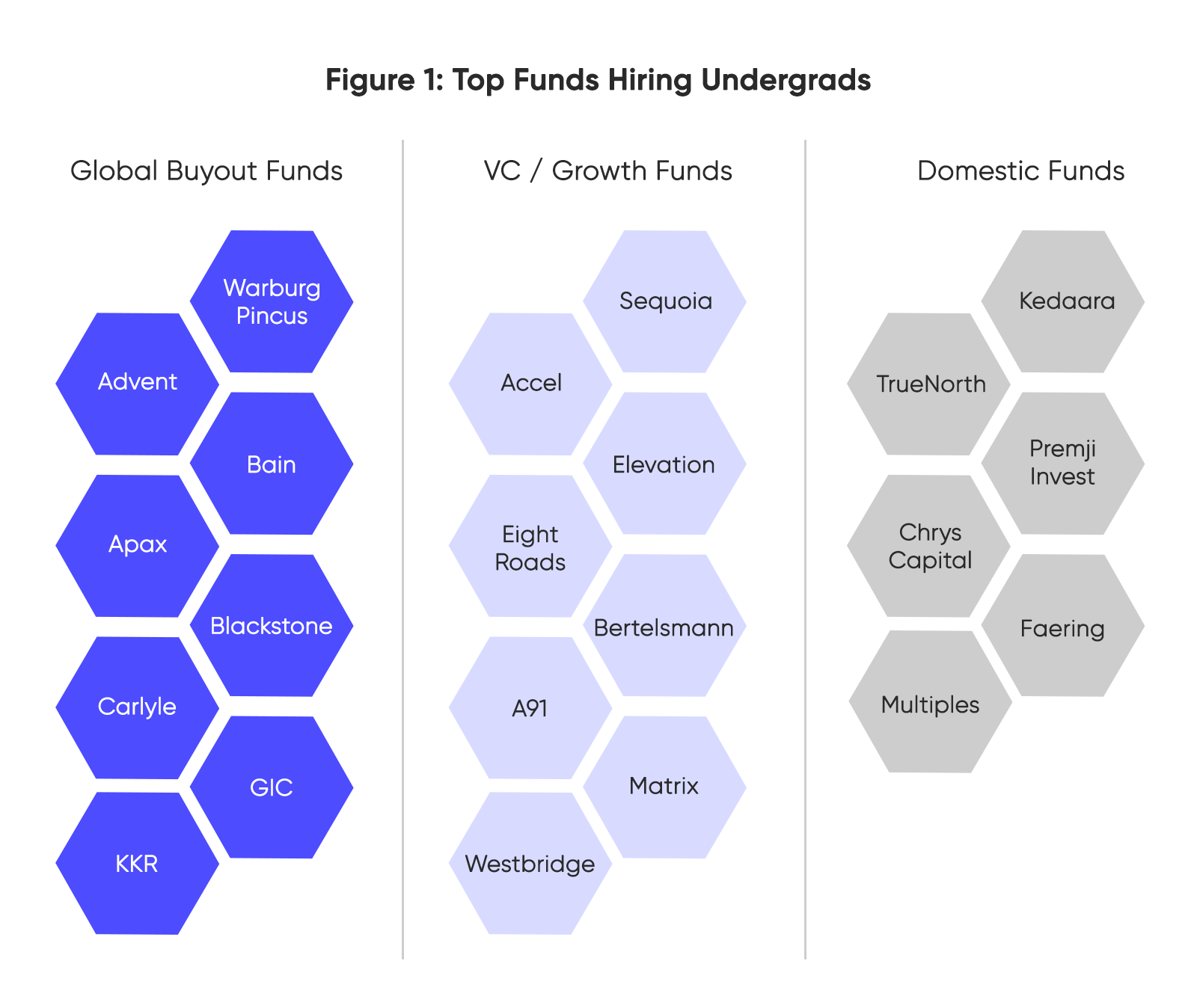

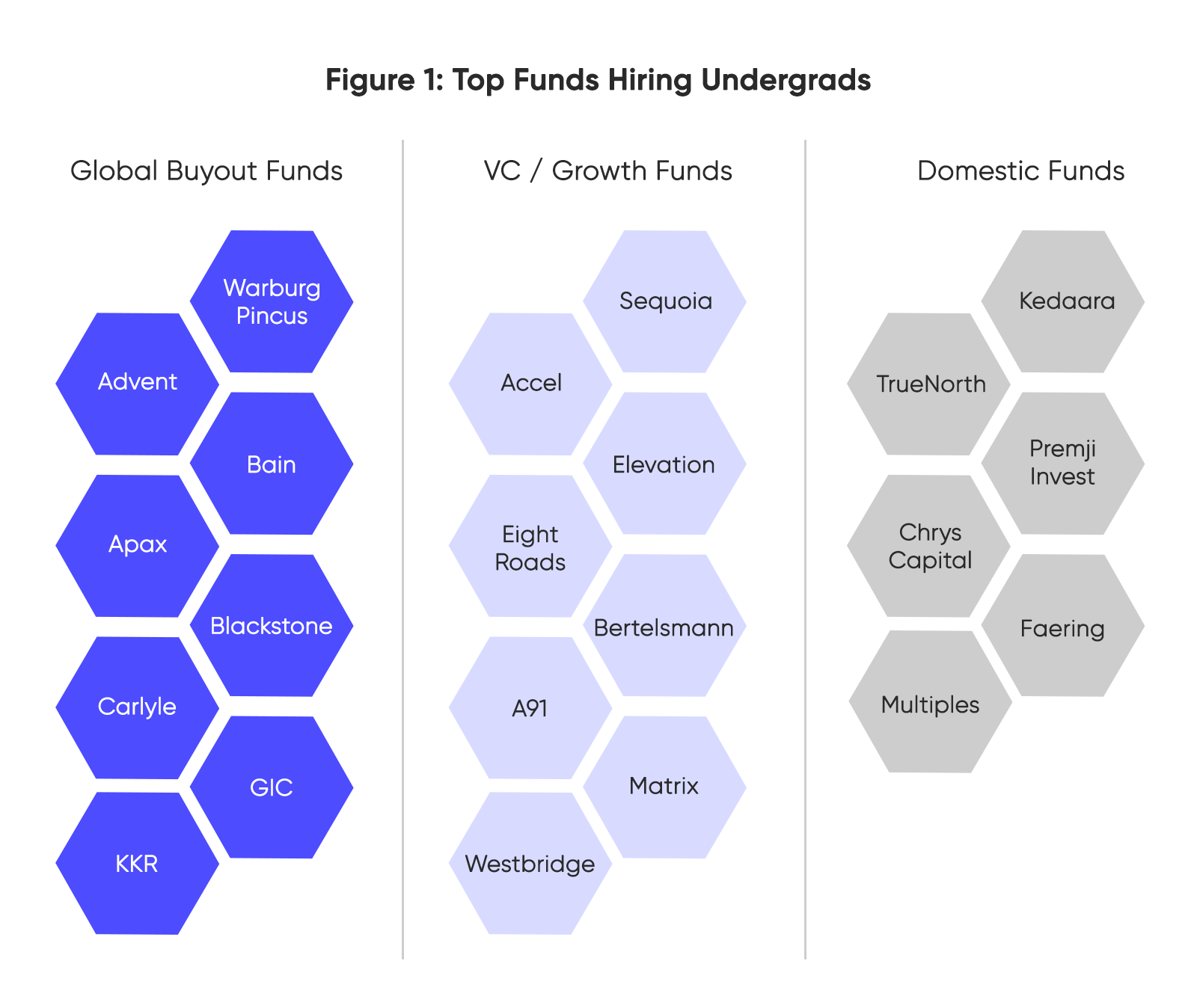

Figure 1 shows top PE/VC Funds that hire undergrads.

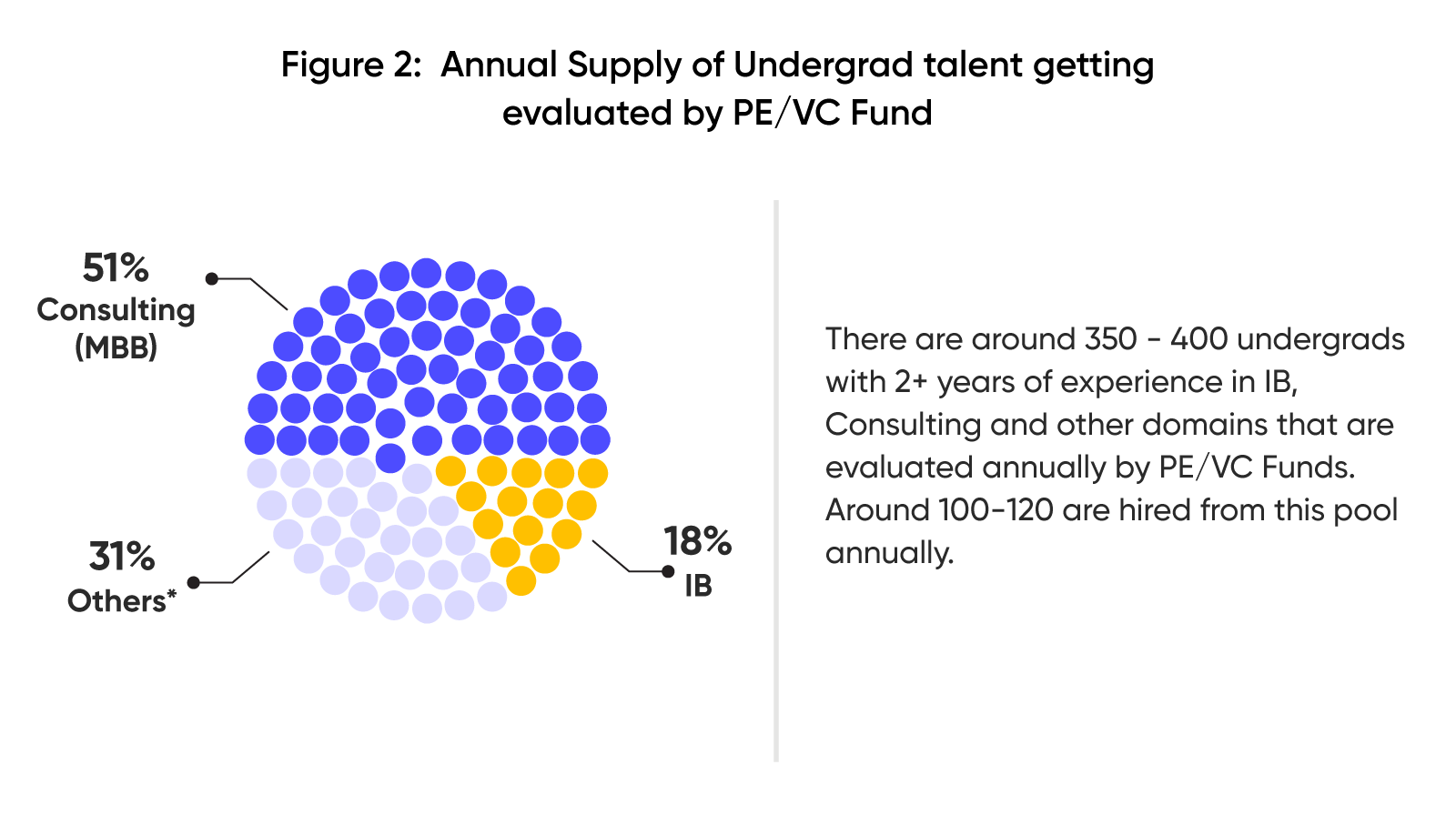

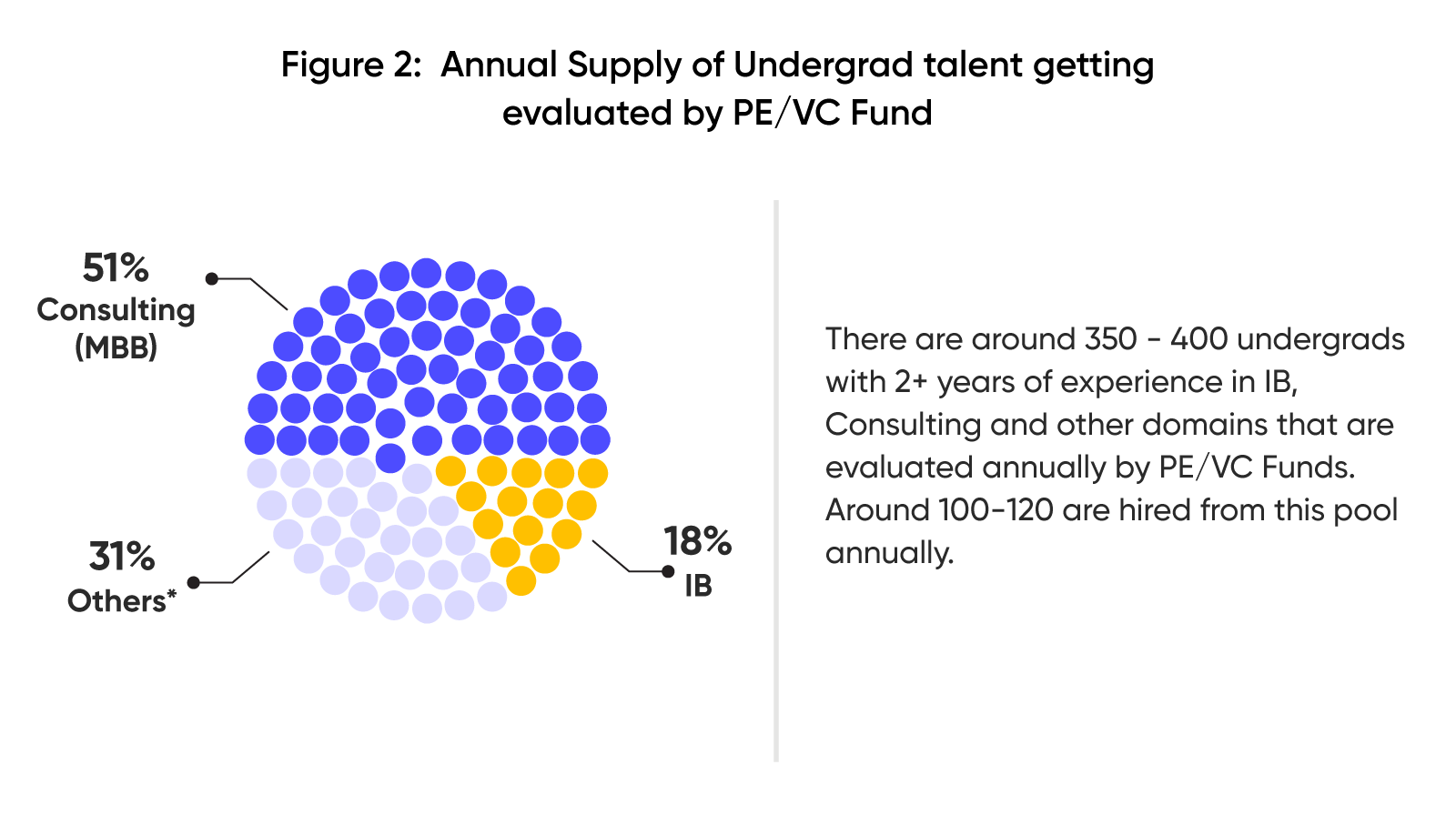

Let’s look at the supply side, first. Most of the PE/VC Funds hire talent from an Investment Banking or Strategy Consulting background. Most undergraduates typically spend two to three years within these domains before joining PE/VC.

Figure 2 shows the overall pool of undergrads across IB and Consulting:

*Others include undergrads from Startups, Off-shore Units of Global Banks, Returning Indians.

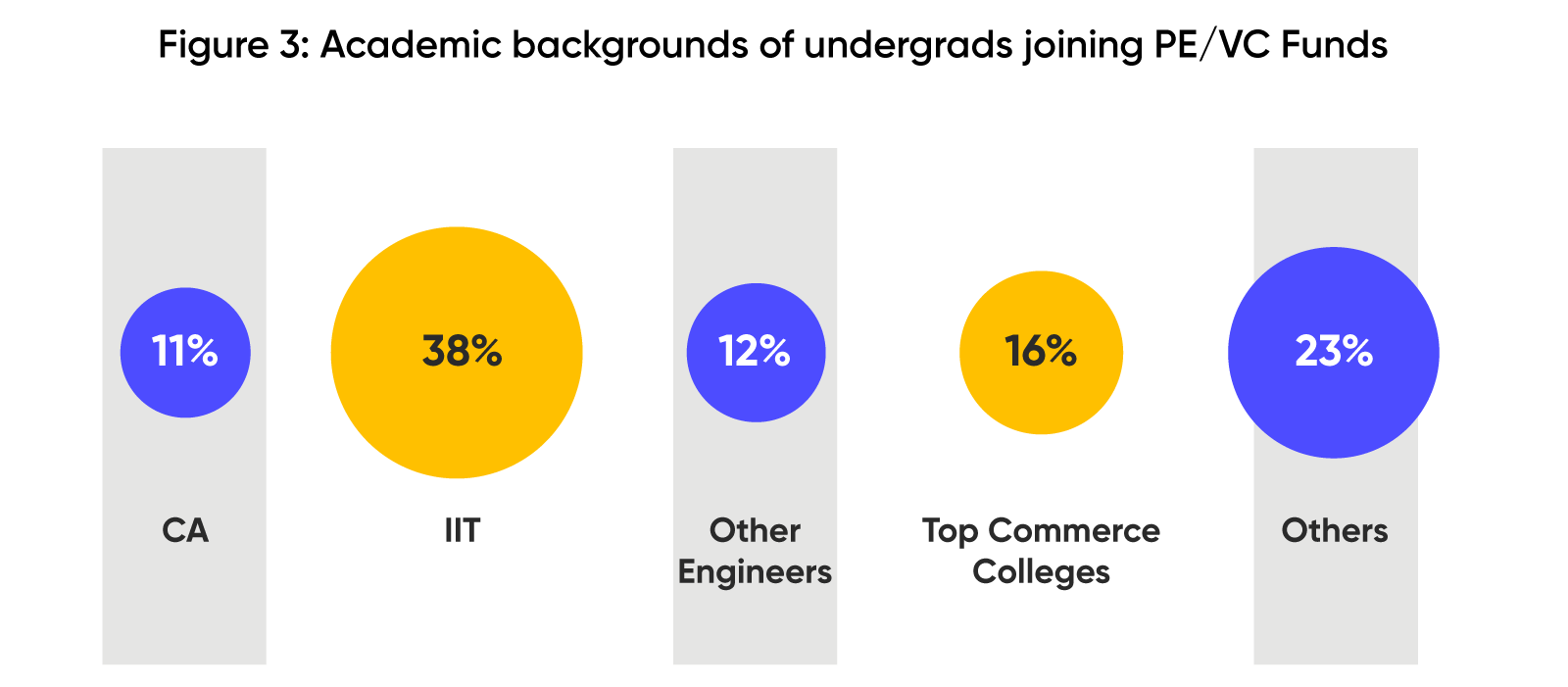

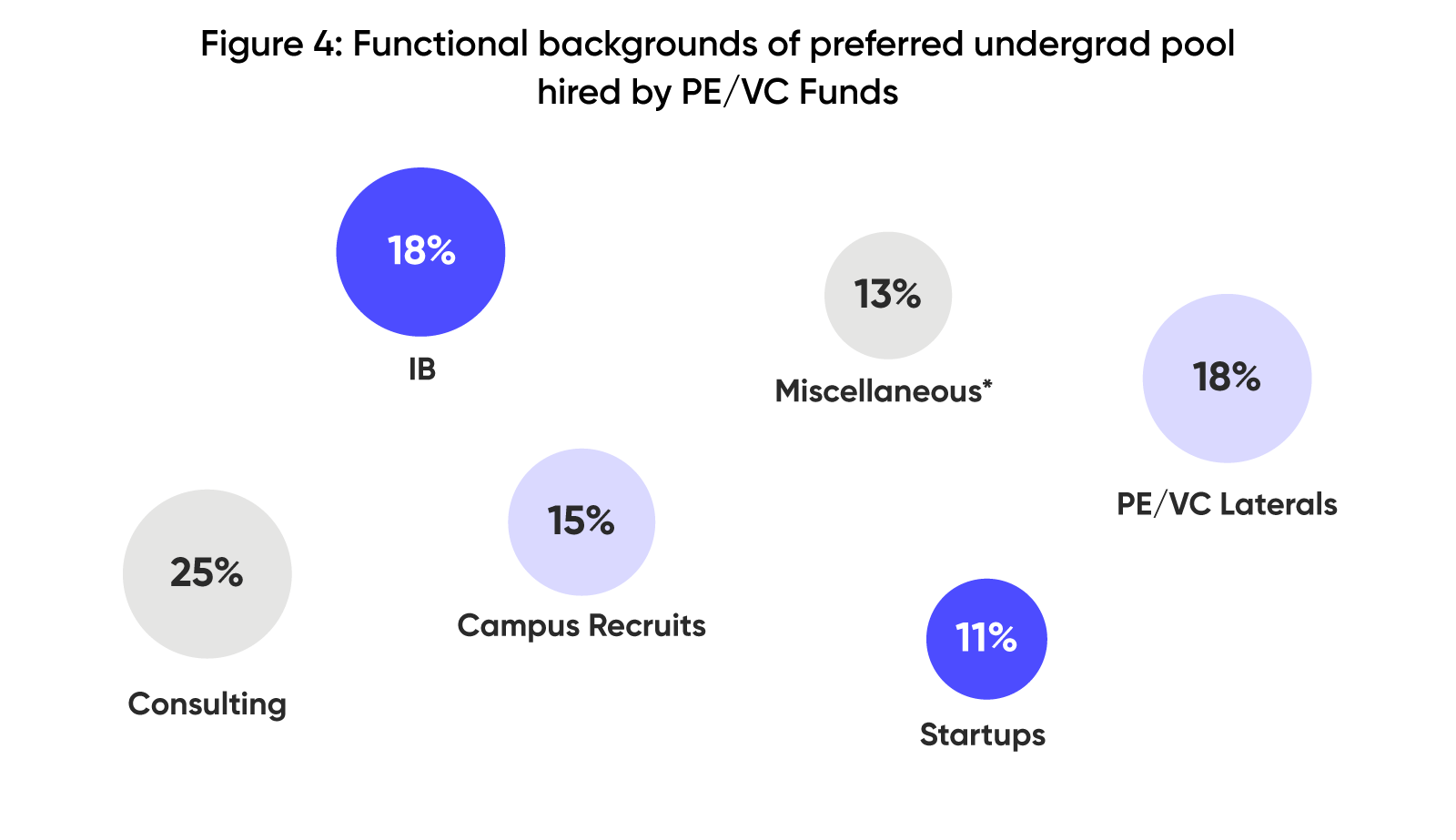

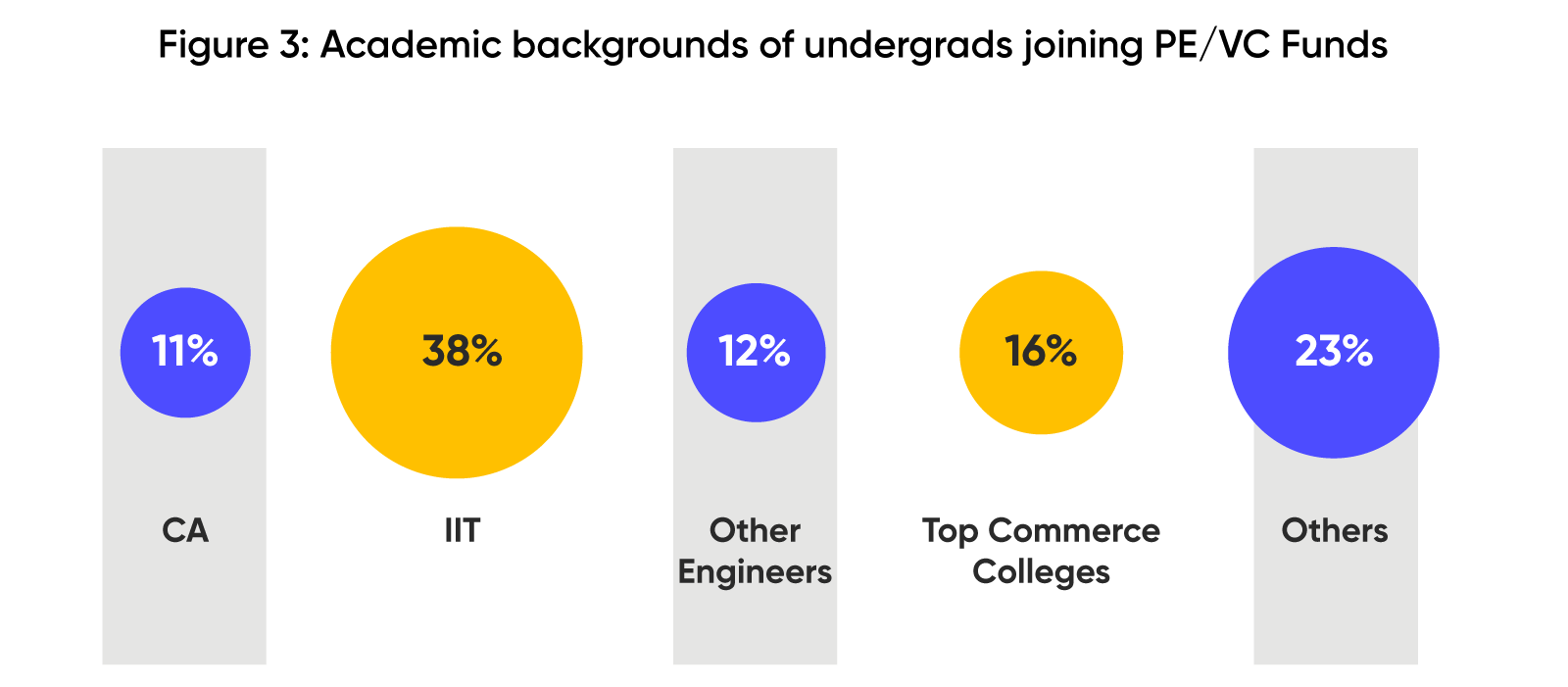

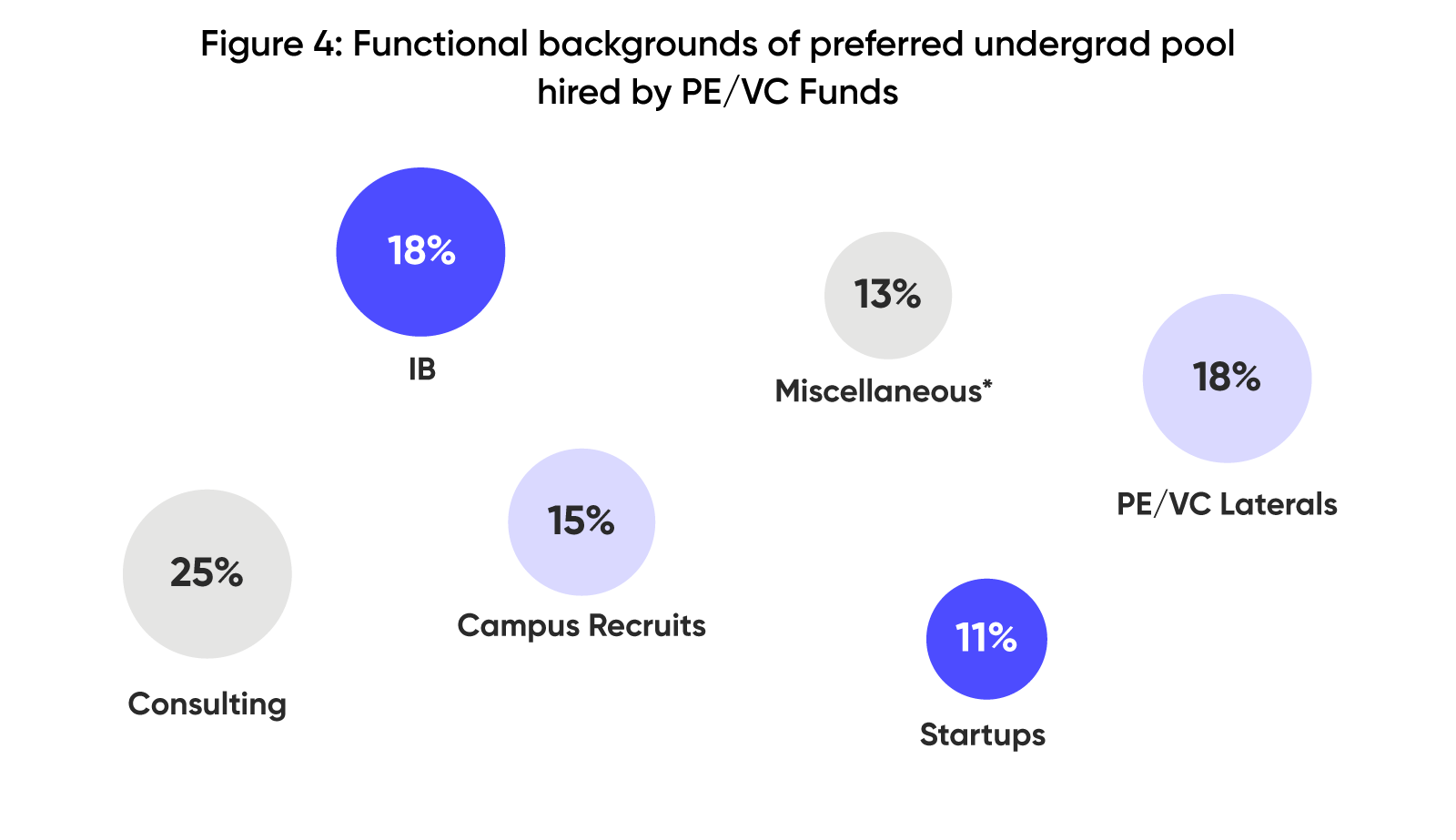

Figures 3 and 4 highlight the number of undergrads from different backgrounds and functional skills who have joined PE/VC firms in the last three years.

*Miscellaneous represents those who have joined from differentiated backgrounds such as functional teams and mid-office outfits from various Global and Domestic IB, Corporate and Consulting Firms.

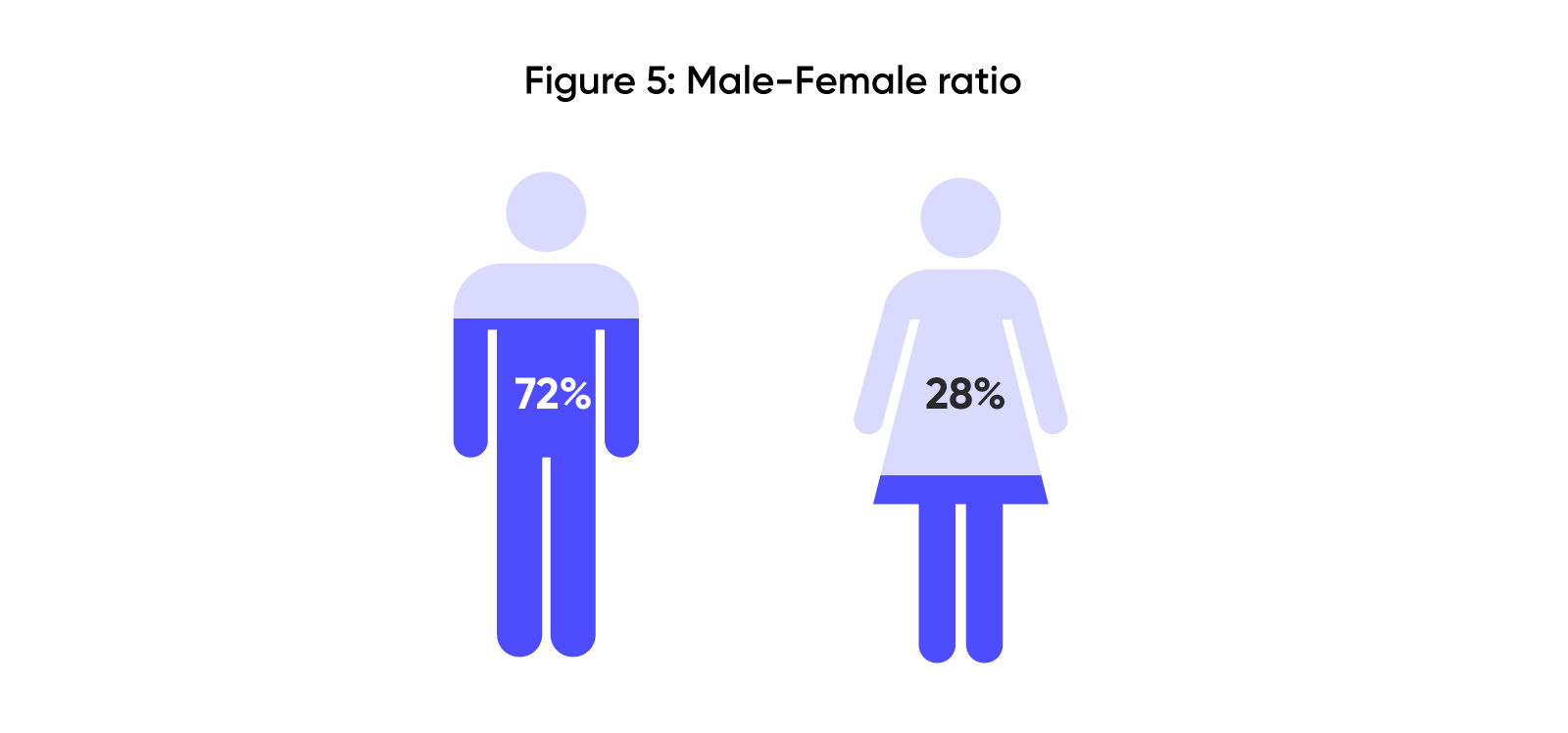

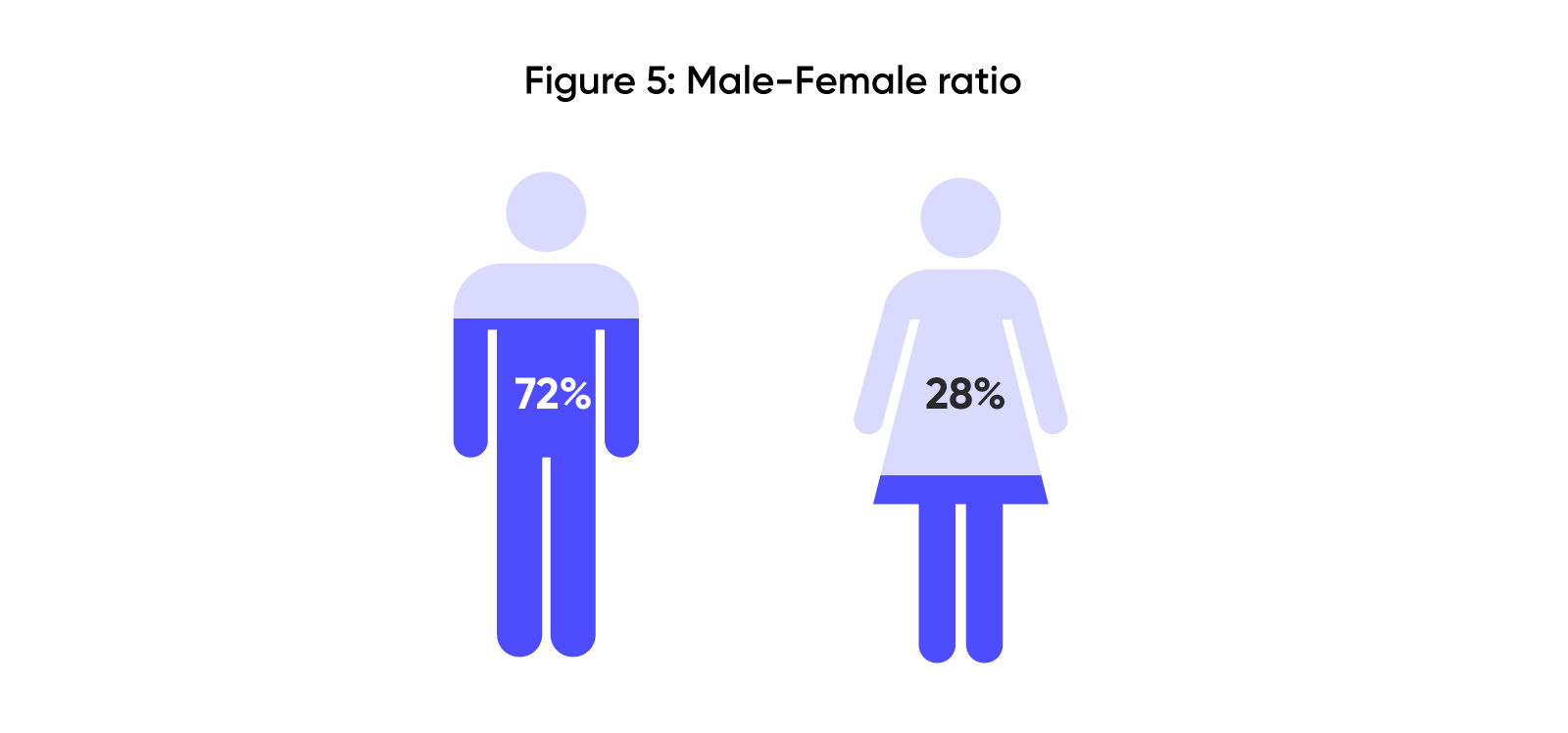

Native also analyzed the demographics of this undergrad talent pool (See Figure 5)

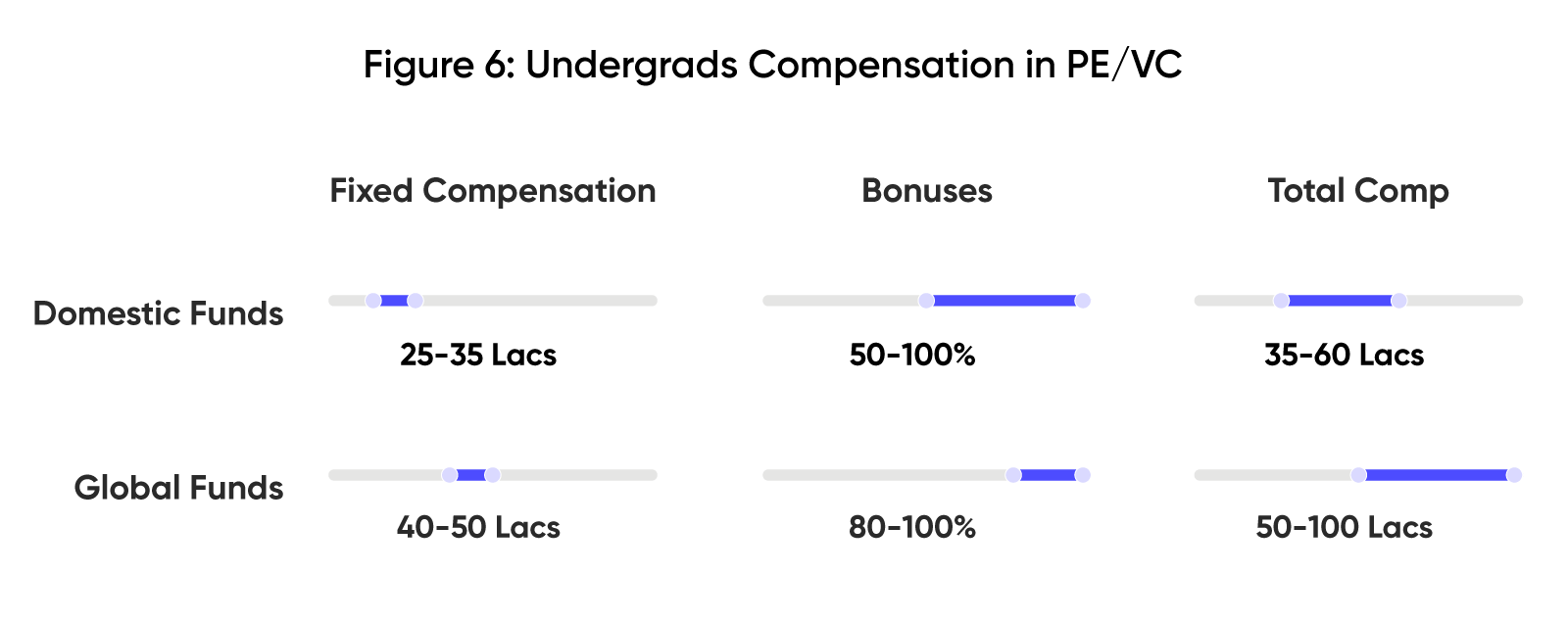

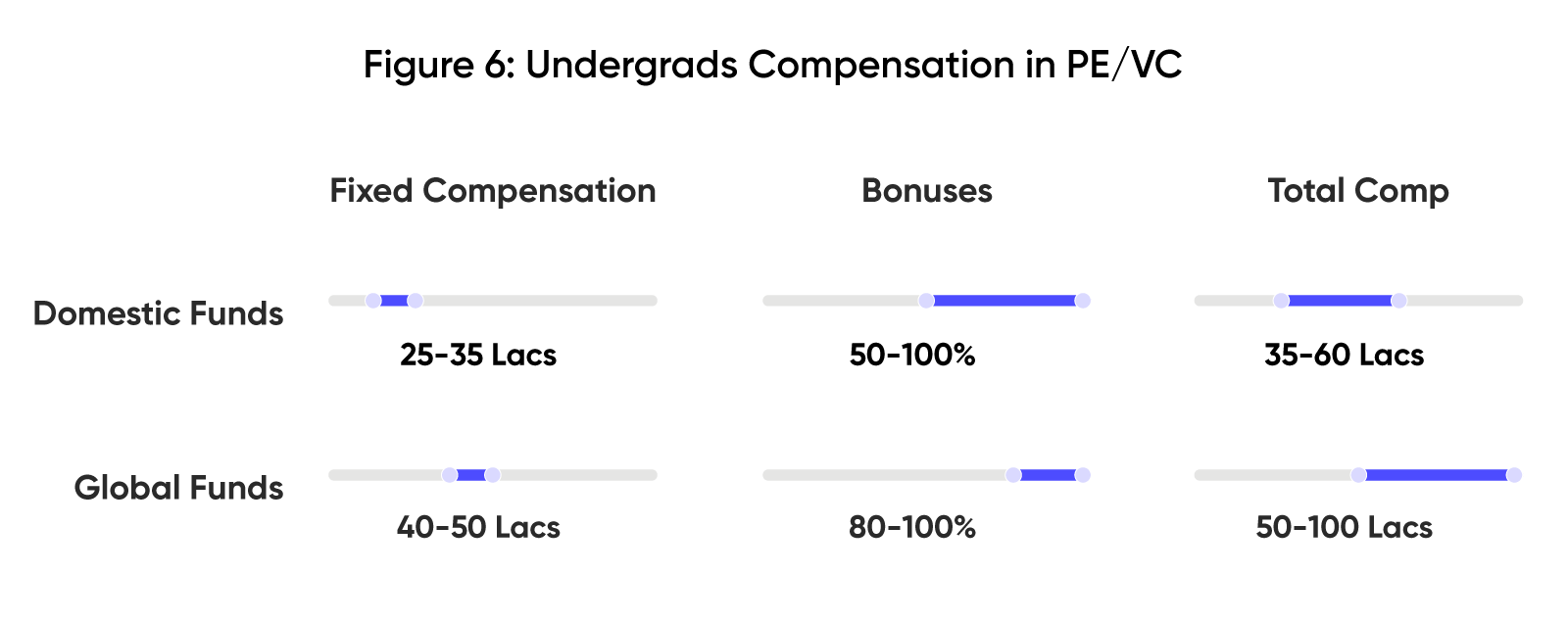

Figure 6 below highlights the compensation packages offered by the Funds:

THE IVY League MBA Factor

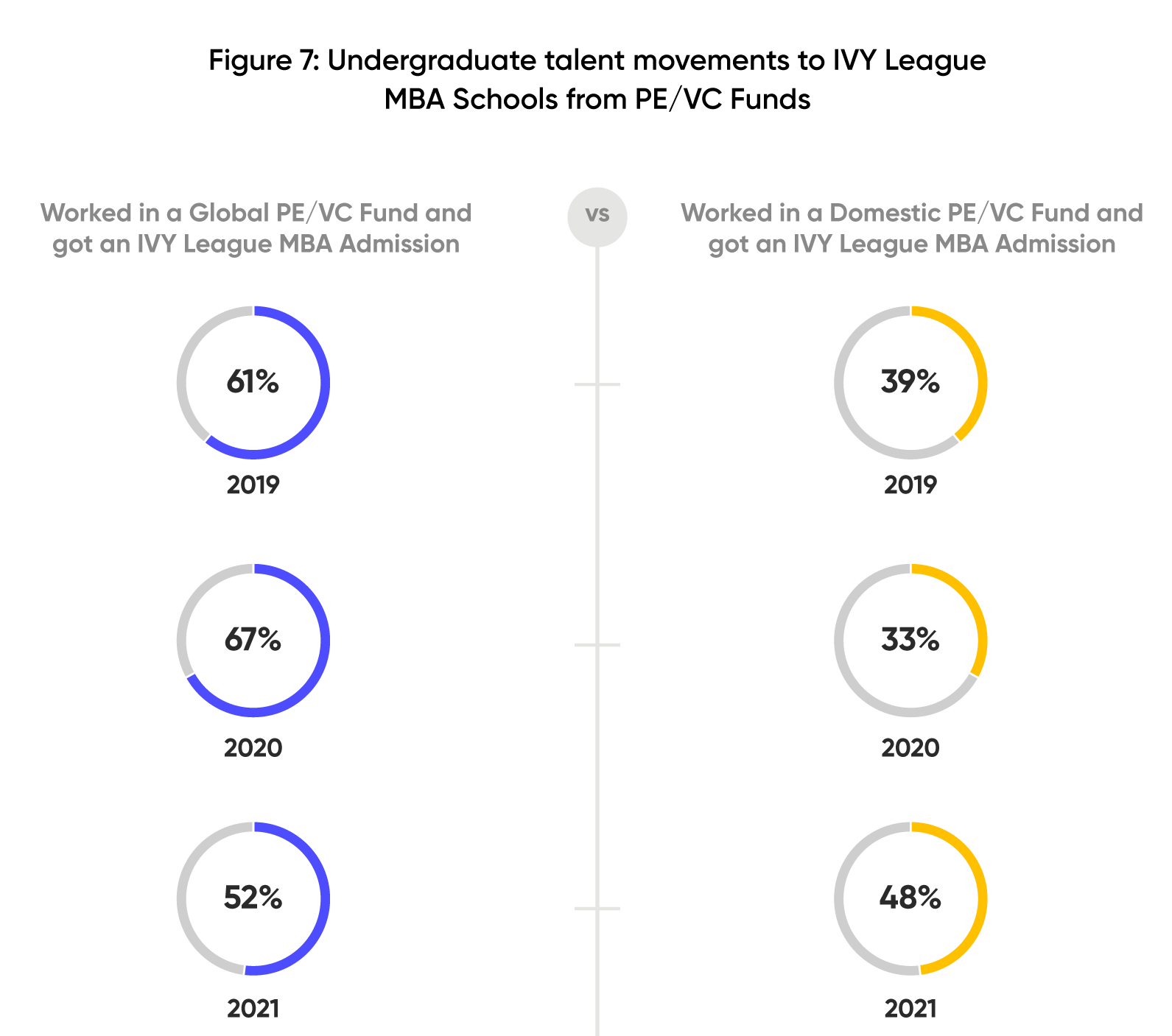

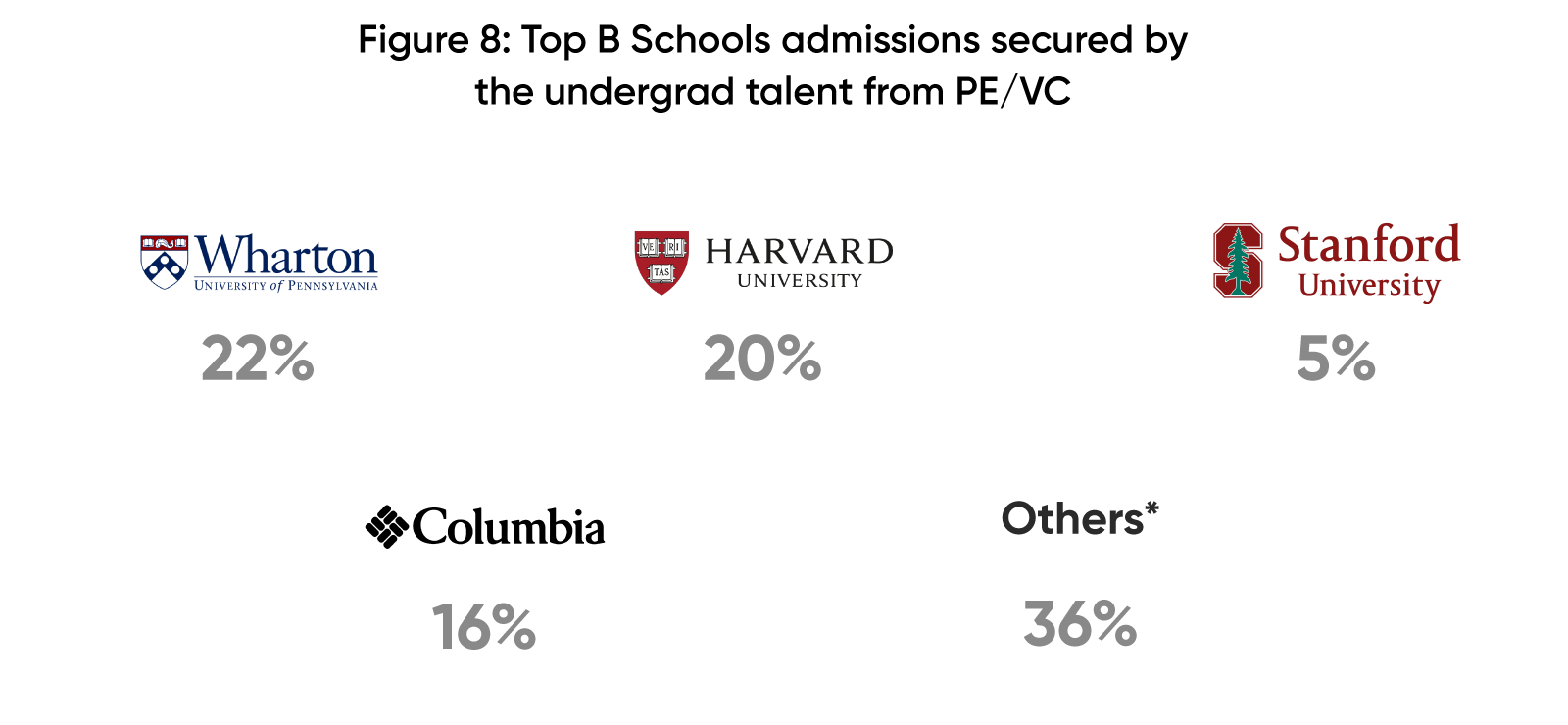

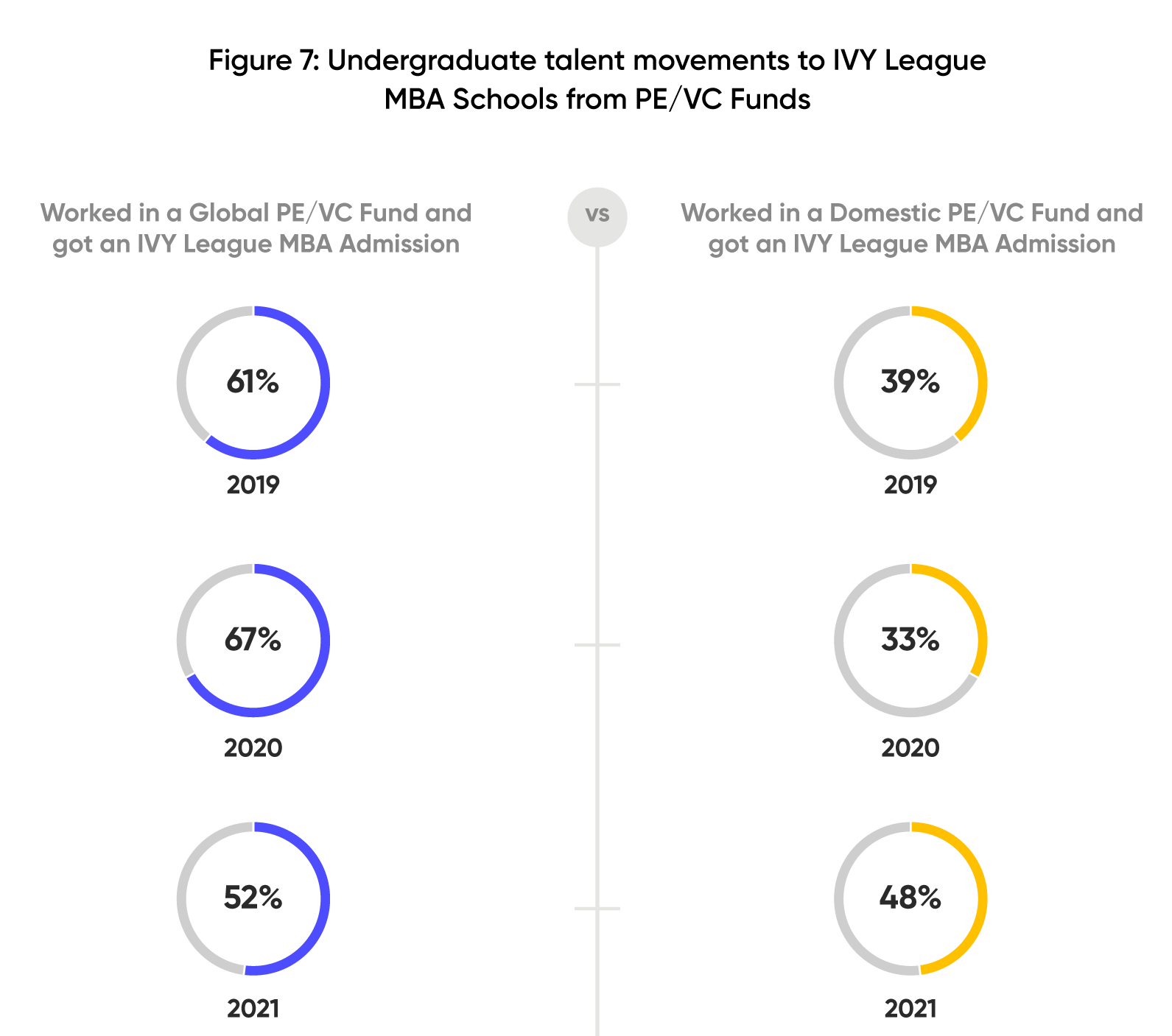

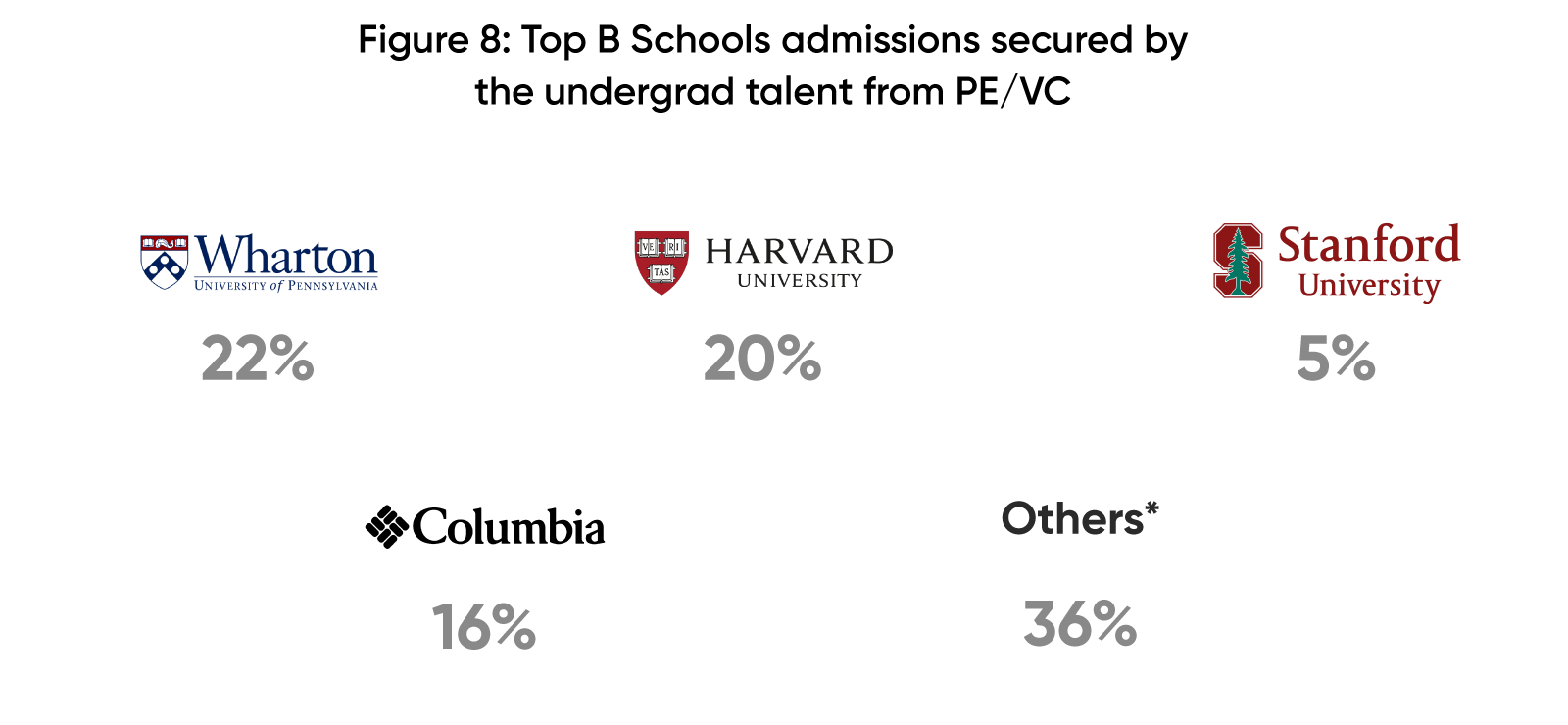

There’s more to the talent journey. Experience in reputed PE/VC Funds is often the first step to global business schools admission and strong recommendations of the alumni network. Figures 7, 8 and 9 below analyze the talent movements to IVY League colleges.

*Others include colleges like INSEAD, LBS, Chicago Booth, Kellogg, etc.

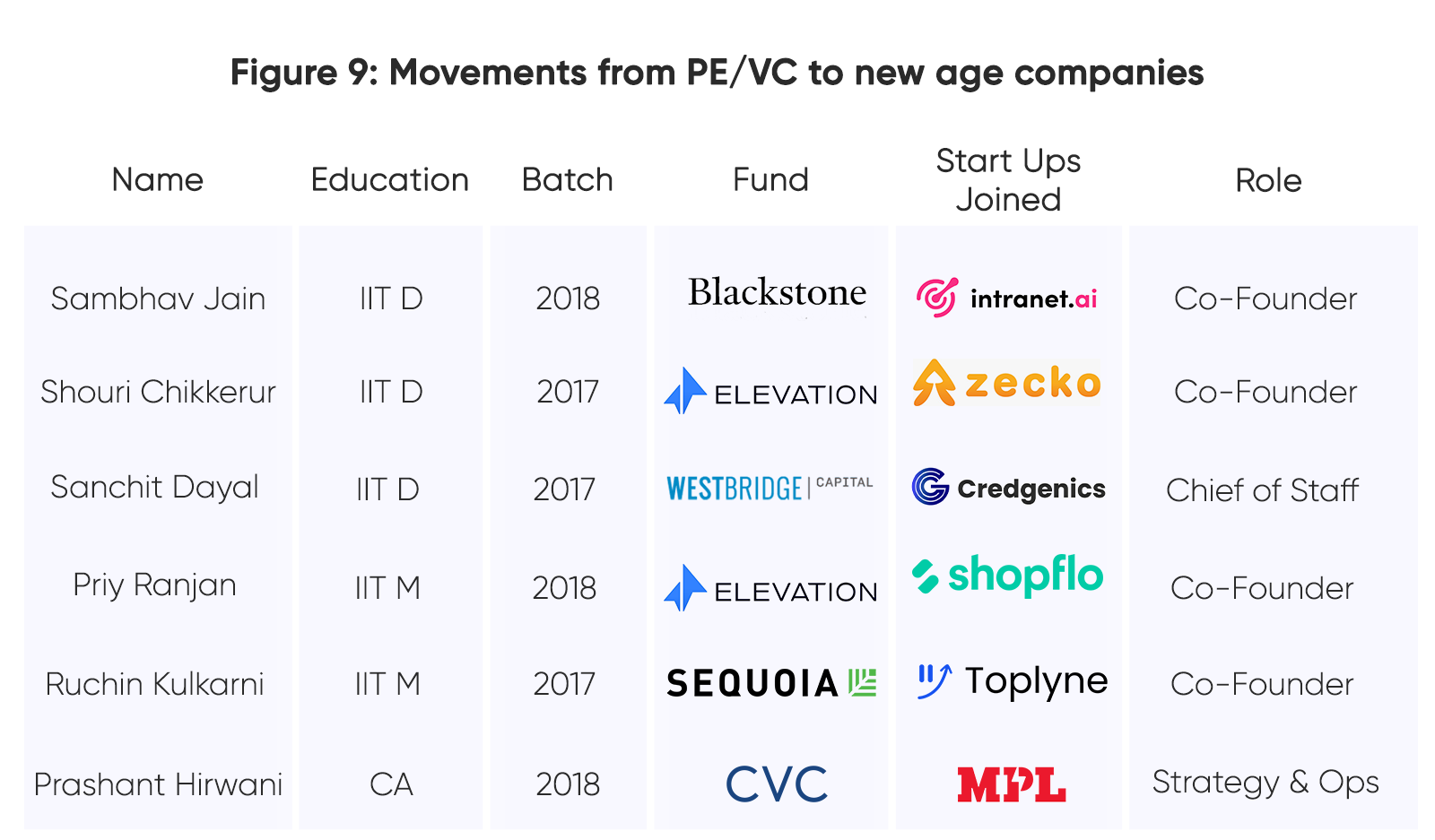

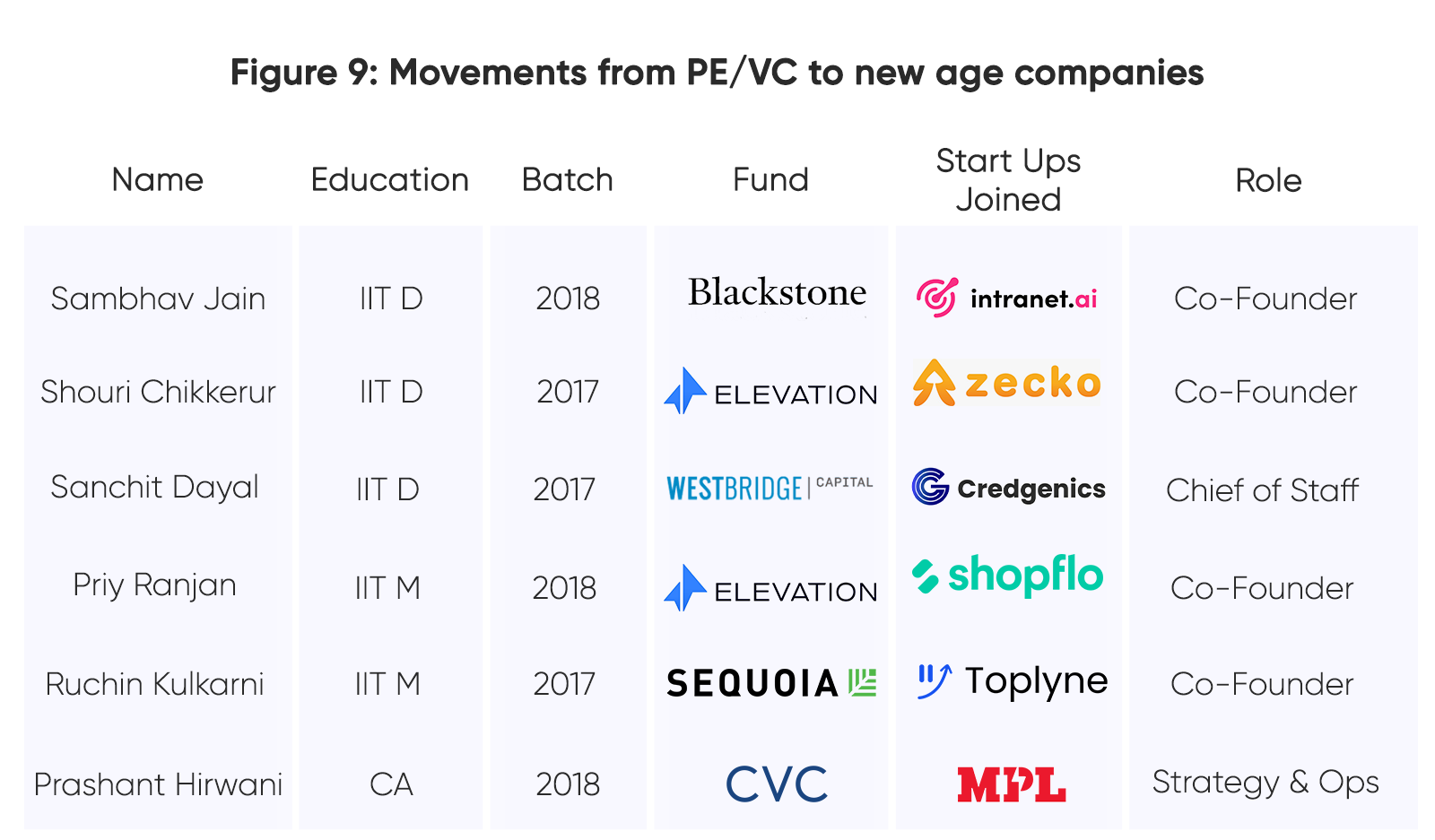

As per recent trends, a large section of undergraduate talent is also attracted to join startups or start their own ventures. Figure 9 shows how start-ups are attracting this young pool of talent.

So, what does the future hold?

Gone are the days when the top talent from premier institutes such as the IITs, SRCC, CA rank holders were thinking of lateral careers. The trend of fascinating learning, money and future in PE/ VC to undergraduates is only getting stronger and therefore the demand for talent is only going to rise. The stepping stone offered by these firms to pursue Global MBAs with IVY League colleges is icing on the cake and the attraction to join PE/VC is going to be on an upward trend.